As more financial institutions consider investing in ITMs, consumer demand continues apace for financial institutions to prioritize convenient transactions AND personalized experiences.

“Especially post-COVID, many banks and credit unions are considering self-service technology like ITMs, as they look at optimizing both their digital and their physical delivery,” says Juliet D’Ambrosio, Managing Director of Strategy for Adrenaline in Believe in Banking’s Ask an Expert. “Of course, ITMs are not new technology, but they are being newly considered as a way to drive some serious efficiency.” This channel has the ability to offload many transactions typically performed by a teller, but can provide a more personalized banking experience, as well.

Implementing ITMs

While we understand that there is no universal standard for rolling out ITM, best practice for deployment calls for locating them not inside the branch, but rather outside the branch – in adjacent locations or in the drive-thru where consumers most want to connect with them. Support is also essential for ultimate implementation success, education takes two paths – one for staff first then employees next. “Employees have to be engaged with a robust training program that teaches not just how to use ITMs,” says Juliet D’Ambrosio. “But why we want customers using them and how that’s going to allow for greater opportunities to make richer connections with customers and members.”

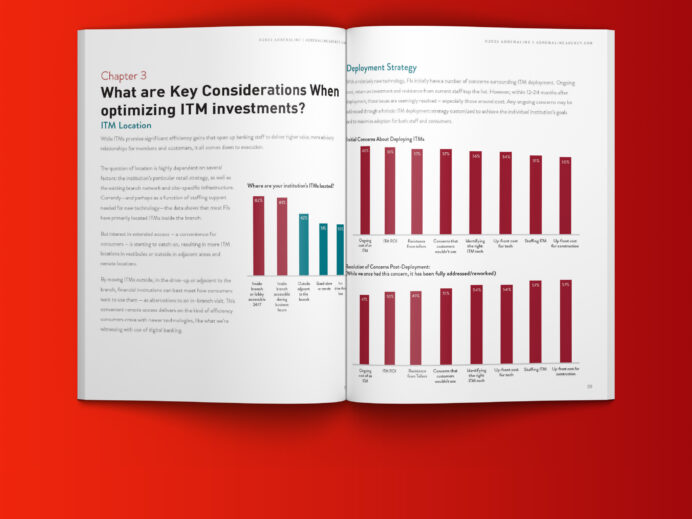

Beyond placement and staff support, it’s also critical to consider the impact of branding, advertising and signage, as well as overarching strategic considerations like aligning capital investments, market opportunities and consumer demographics within an enterprise-wide branching strategy. It’s also illuminating to look at how institutions have rolled out ITMs, what they have learned along the way and how they overcame any challenges. Adrenaline’s research finds FIs report wide-ranging concerns, primarily focused on location. Construction costs were an initial issue, but one that was soon addressed by partnering with experienced providers.

Consumer Adoption & Staff Support

As with any new technology, the ITM may feel a little intimidating at first, but with enough exposure, soon consumers will use them with ease, just as they do today with ATMs or self-checkout. Even more, ITMs bring important functionality not available with purely self-service options. The staffing element integrated in ITM opens up a world of possibilities. Yes, customers can do quick self-service transactions when they need to, but they can also have their more complex needs addressed through consultations available on-demand. This is the kind of self-directed banking consumers report they want out of a modern banking experience.

In tandem to a communications campaign, staff support is foundational to education efforts, providing for a customized response to customer or member questions or concerns. Insights gathered from institutions deploying ITMs find that success and ROI hinged on a significant investment in internal training programs – empowering staff to confidently support customer adoption of this new technology. In tandem to external communication measures, staff played a large role in successfully driving new customer or member onboarding experience to maximize this new banking tool.

In part five of our ITM White Paper series, we’ll discuss final considerations for determining whether ITM is the right investment for your institution and even more research-driven considerations and best practices. If you’d like to discuss custom ITM solutions for your branch network, we’d love to hear from you. Reach out to us at [email protected] and we’ll connect you with one of our experts.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.