ITM Best Practices & the Future of Self-Service Banking

In part six of Adrenaline’s ITM series, we review ways for banks to take full advantage of ITM’s potential and look at the future of this transformative technology

Download The Whitepaper

ITM Best Practices at a Glance:

- Location is one of the most hotly contested ITM topics, but research finds clear best practices, with access being the primary consideration

- By having ITMs in prime locations, banks can continue to build their brand influence in the market

- For consumers and institutions alike, ITMs can deliver the ideal balance of efficiency and experience that helps future-proof successful banking relationships

With self-service tools becoming an integral part of the modern banking experience, most institutions are investigating how to add ITMs to their retail delivery networks.

As 52% of banks and credit unions report expanding the number of ITMs in their network, according to 2023 NCR data, institutions are exploring how enhanced self-service can deliver the experiences customers want with the efficiencies organizations need. For consumers, these self-directed formats connect to larger branches, but expand a bank’s influence and extend its convenience. “Most of our clients are considering deploying ITMs and many have deployed them,” says Gina Bleedorn in an interview with the Financial Brand. “But everyone is trying to figure out the best use cases, where to put them, how to staff them, and how to shift consumer expectations around them.”

Deployment Decisions

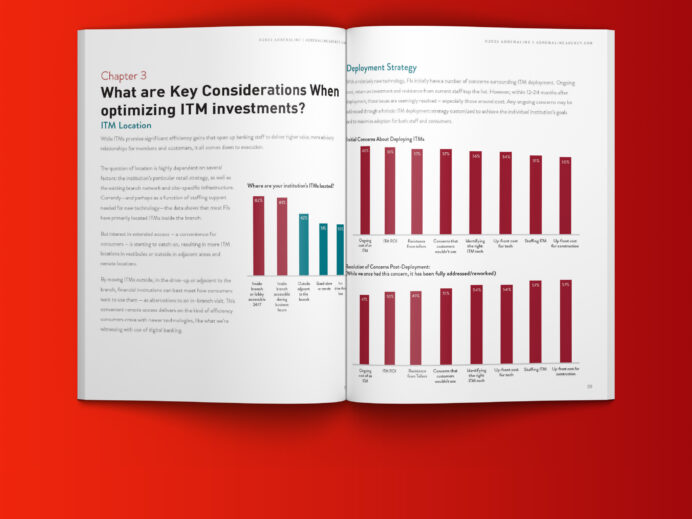

Knowing when your institution is ready for ITMs and how to properly plan for them will define how successful a deployment will be. If a bank or credit union is considering new ITM locations in an already crowded market, is imminently switching core systems, or if the banking channel is being introduced into a market without support of other formats in a hub-and-spoke network, now might not be the optimal time for introducing ITMs. But if your bank or credit union is looking for more efficiencies while growing market share, optimizing staff and replacing an aging fleet of ATMs, ITMs might be the right solution right now. “If I can look like I’m in more places as efficiently as possible, I want to do that,” says Gina Bleedorn to the Financial Brand.

Our staff loves the ITMs because they can focus on bigger value sales. There are fewer people coming into the branch, so we need to make those individual visits count. The technology actually has the effect of elevating our people.”

Location is one of the most hotly contested topics in ITM deployment, but our research finds some clear best practices, with access being the primary consideration. ITMs are most successfully located in the drive thru or in remote kiosks with high visibility. ITMs are also effective if they’re distributed prominently across the retail network and in proximity to a recently-closed branch site. By having ITMs in these prime locations banks can continue to build their brand influence. This might be where banks need more presence or as a leave-behind where a full-service branch no longer makes sense. “Those can be very cost-effective points of presence,” says Gina Bleedorn to the Financial Brand.

They’ve helped us right-size the network, because when we’ve had to close a low-opportunity branch, we leave an ITM to maintain our commitment and those customer relationships.”

While other self-service banking tools like mobile banking take on the bulk of transactional volume, ITMs solve for more than one challenge facing FIs today. In fact, interactive teller machines and other self-service tools can help jumpstart a financial institution’s branch transformation program, driving new delivery methods and informing their network strategy, including hub-and spoke format strategy and deployment. ITMs also influence branch design, since they’re able to detether transactions from the teller line. This frees up space in retail design and site layout, empowering branches to become centers of consultation and connection versus places for transactions.

Future of Financial

Looking ahead, ITMs will surely improve in speed, efficiency and cost per transaction, undoubtedly automating the banking process even more. What appears to be just on the horizon is the concept of “ATM as a service” with manufacturers providing full outsourced management of ATMs and ITMs, which can lower capital expenditures even more. But in the near-term, the collective benefits and ability to bridge the best of digital and physical worlds make ITMs a powerful tool and a key component of a growth-oriented retail strategy. For consumers and institutions alike, ITMs can be a way to deliver on the “holy grail” balance of efficiency and experience that help future-proof successful banking relationships.

I think the innovation, ease and access [of ITMs] are much better for our talent and our customers.”

For more information on remote delivery and ITM deployment, or if you’d like to discuss custom ITM solutions for your branch network, contact Adrenaline today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.

Read More ITM Insights