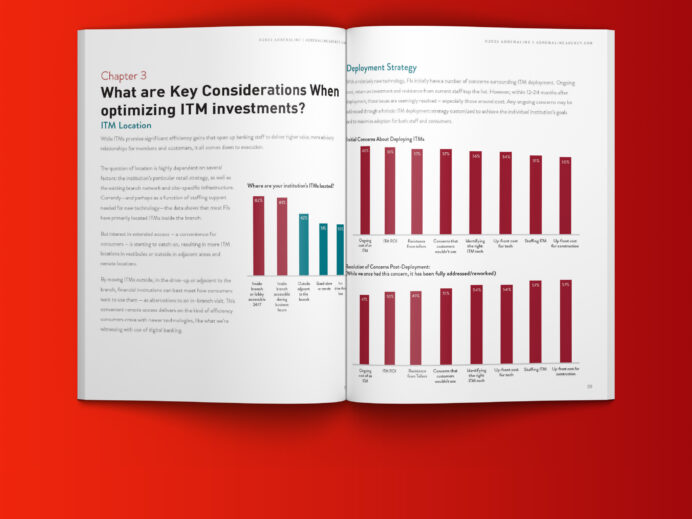

Decisions around whether and when to deploy ITMs hinges on each individual institution’s unique retail delivery strategy and how they plan to meet consumer demand.

While it’s clear that consumers want the convenience and accessibility of digital channels in banking, they also crave a more human experience when they need financial advice. In fact, data consistently finds that customers prefer financial counsel delivered via a knowledgeable, trusted banker from their primary FI, with nearly 6 in 10 consumers reporting more customized counsel completely meets their needs and 55% saying it seemed “personalized” when delivered by a person.

That means that the increasing pressure to go all-in on digital can bring some key opportunities for engagement. Recently Canadian banking leader RBC talked about their approach to retail delivery innovation in a VentureBeat article, describing balancing a complex set of challenges. “At RBC, we faced a number of these hurdles — after all, RBC is more than 150 years old, one of the largest banks in the world based on market capitalization and serves 17 million clients in 29 countries, with more than 800 million transactions a day.” Serving a diverse customer set means delivering “solutions that meet consumers’ expectations in 2022 and beyond.”

Banking Satisfaction

In creating a modern banking experience for customers, ITMs are part of an overarching delivery strategy that must be both current-state and future-facing at the same time. It’s clear that success in ITM deployment depends on a multitude of factors – from consumer adoption to institutional commitment and more. On the consumer side, the benefits of ITMs are both clear and immediate, centering around convenience and a better banking experience.

With ITMs, consumers appreciate:

- Expanded banking hours, in line with consumers’ on-demand expectations

- Convenience and safety of drive-up banking

- Teller guidance for less tech-savvy customers

- Multi-lingual teller choice for an enhanced, inclusive experience

- Easy ID verification if card is lost or stolen

- Faster transactions — less waiting in line for a teller either in branch or in the drive-thru

- ‘Closer-to-me’ access with remote ITMs as part of the branch network

For institutions, ITM satisfaction is related to how well the technology can integrate with other key banking systems. Core technology integration is a chief factor for the level of efficiency the ITM delivers and its overall satisfaction among key members of the C-suite and institutional leadership. When fully integrated with core, the technology lives up to its full self-service potential, with a financial institution’s customers and members able to complete most transactions on their own – but still have the option to connect with a teller as needed.

Without full core integration, ITMs are still a valuable investment, because they remain a way to deliver high efficiency and experience on the consumer side. But on the institutional side, they’ll require more FTE support to deliver on the expected experience, since the video teller will be the one to complete the transaction on behalf of the customer. Ultimately, the challenges for institutions around ITMs come from initial cost considerations; location for optimal use; and staff and customer training necessary to drive adoption.

In the final installment of our ITM White Paper series, we’ll revisit best practices and ways to know if your institution is ITM ready. If you’d like to discuss custom ITM solutions for your branch network, contact Adrenaline today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.