ITM White Paper Series: The Power and Potential of ITMs

In part one of our series, we explore what ITMs deliver for financial institutions and the consumers they serve

Download The Whitepaper

One of the biggest consumer demands in financial services today is self-directed banking.

Distinct from self-service options where consumers do everything for themselves, self-directed banking empowers customers or members to choose what works best for them at the right time and place in their banking journey. Sometimes that’s fast efficiency for transactions – like using online and mobile banking – and sometimes it’s human consultation and support – like what consumers can get at their branch. Now, the best of both worlds is available at a hybrid machine that bridges the digital and physical worlds.

It’s clear that consumers are prioritizing a seamless omnichannel experience in all areas of their lives. Banks are responding to this demand with tools that meet consumers at the point of need, increasingly leaning on enhanced omnichannel options like ITMs. Interactive Teller Machines marry all the benefits of an ATM, but with expanded functionality. That means ITMs can provide the conveniences consumers have come to expect from an ATM, like cash withdrawals, check deposits and balance inquiries, PLUS advances and access to live video tellers for more complex banking needs, like opening accounts and applying for loans or credit.

ITM Capabilities

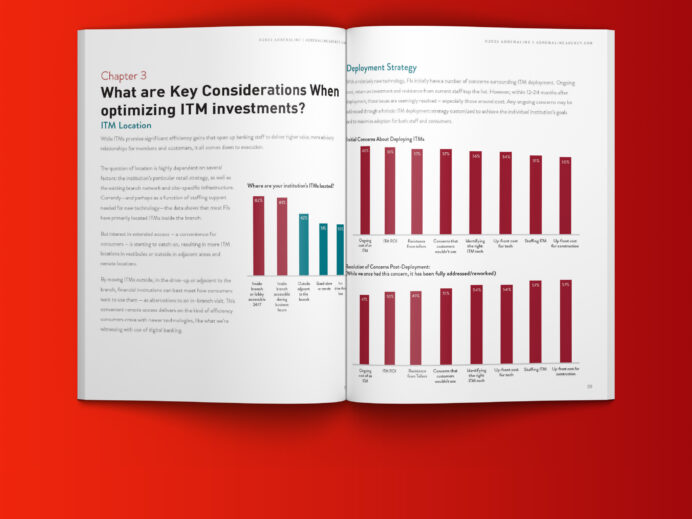

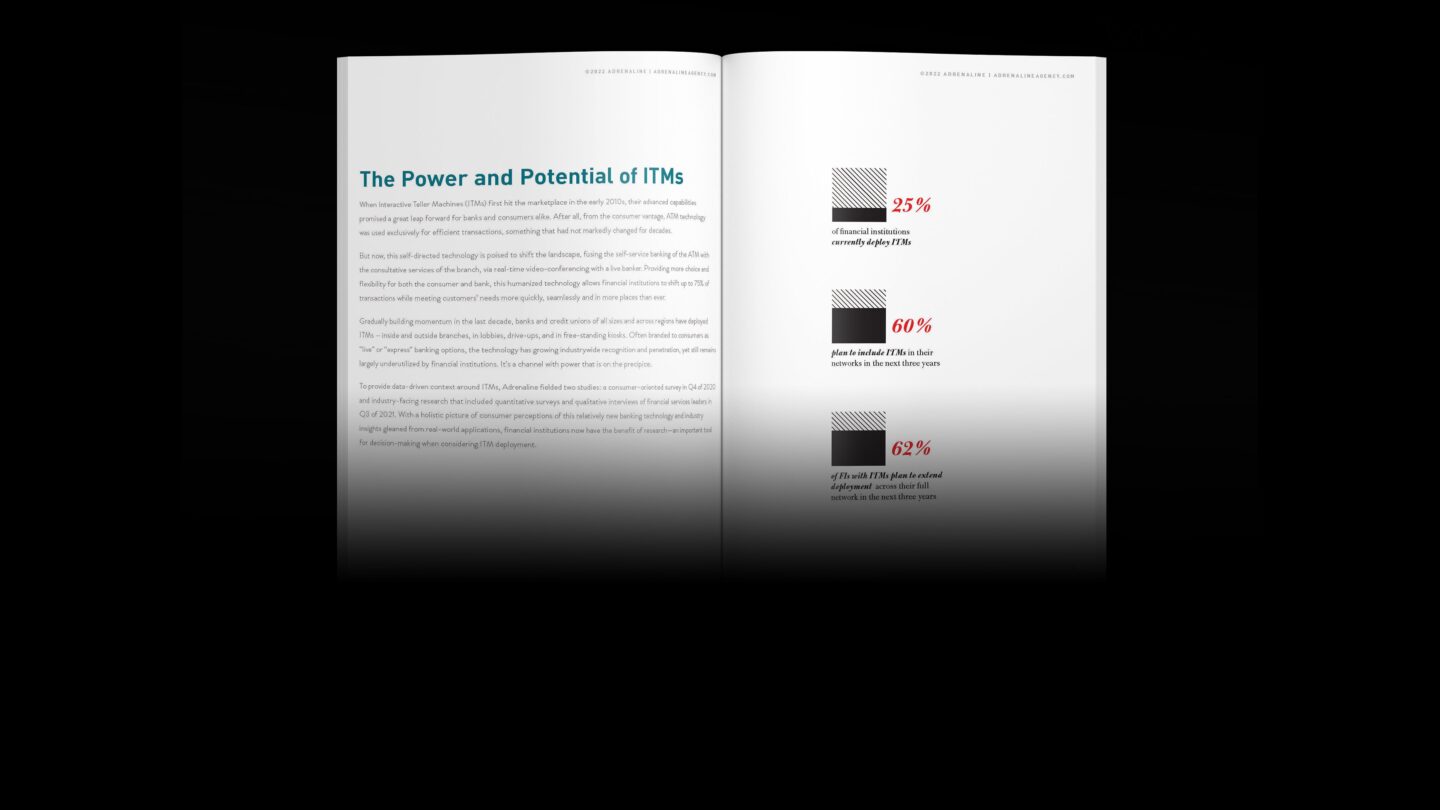

Not only is the ITM great for consumers, it also helps banks dedicate resources where they’re most needed. In fact, this humanized, flexible option allows financial institutions to shift up to 75% of transactions while meeting customers’ needs more quickly, seamlessly and in more places than ever. According to ITMs: Bridging Digital and Physical Worlds: “Gradually building momentum in the last decade, banks and credit unions of all sizes and across regions have deployed ITMs – inside and outside branches, in lobbies, drive-ups, and in free-standing kiosks.”

Often branded to consumers as “live” or “express” banking options available to consumers, these hybrid machines have increasing industrywide recognition and penetration, yet they still have a way to go before they’re universally deployed, as smaller, more efficient spokes in a hub-and-spoke model. Given that ITMs expand the ability of what a customer can accomplish – in many cases matching what a live, in-person teller visit can do – ITMs offer a true alternative to a branch visit for most transactions.

In part two of our ITM White Paper series, we’ll explore whether this self-directed technology is a good investment and provide industry-leading insights to help banking leaders make the best decisions for deploying them. Contact Adrenaline to discuss custom ITM solutions for your branch network.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real. Get in touch today.

Read More ITM Insights