As online and mobile banking took off during COVID, one thing became crystal clear: consumers want to have more control over their own banking experiences.

“Data prior to the pandemic demonstrated consumer behavior moving towards opt-in mobile and remote delivery banking; COVID just sped it up,” according to Believe in Banking’s Why Banking Is Investing In ITMs. “Further, ITM deployment does more than meet consumer demand; it advances efficient banking experiences – just like the ATM that came before it – which delivers benefits for the consumer and the financial institution, alike.” But what exactly are those benefits?

“What we know by looking at this research is that ITMs appear to be a great investment for institutions that are looking to balance both high customer experience and efficiency,” says Juliet D’Ambrosio, Adrenaline’s Senior Director of Strategy, describing new research in ITMs: Bridging Digital and Physical Worlds. “When we look at the consumer side of the research, we know that consumers of all generations have a really high interest in and satisfaction with using ITMs. On the institution side, the research tells us that of those banks and credit unions that have employed ITMs, 70% of decision-makers are extremely satisfied with their use altogether.”

Efficiency and Experience

Beyond satisfaction scores, ITMs deliver seamless omnichannel options that consumers demand and efficiency that’s essential for financial institutions in this competitive environment. For banks and credit unions, ITMs reduce costs by leveraging remote tellers who are not tied to specific local branches, but rather who can serve multiple ITMs across wide geographic areas with significantly reduced cost per transaction. Although cost to initially deploy ITMs may be significant, financial institutions implementing them see savings almost immediately – through staff productivity and lower cost-per-transaction and FTE expenses.

On the consumer side, our research shows that people look forward to using this technology, if they haven’t already, and when they do, they’re very satisfied with their overall experience. In fact, consumers see the expanded features that ITMs offer as an effective replacement for going inside the branch – a real-time-saver with wide-ranging options allowing them to self-direct their banking activities. With a full menu of services available – from applying for credit and opening accounts to bill pay and account management and support – it’s clear people use them as more than simply glorified ATMs.

Institutional Insight

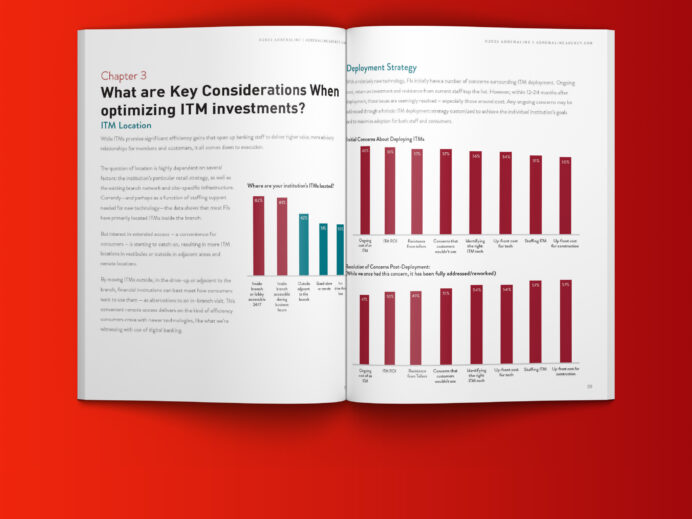

For financial institutions, ITMs provide a bridge between digital and physical that has the power to transform how banks serve customers. Our data shows the goals of FIs in deploying ITM reflect the same sort of sentiment as customers and put FIs in a position to improve customer experience and increase revenue per customer. Institutional data demonstrates that when strategically deployed, ITMs are able to facilitate many transaction types and move them away from resource-intensive in-person teller visits. Additionally, bank leadership and staff have high levels of satisfaction with how ITMs exceed customer experience expectations.

In part three of our ITM White Paper series, we’ll discuss considerations for banks and credit unions to make the most of the ITM investment, including location and deployment strategy. If you’d like to discuss custom ITM solutions for your branch network, we’d love to hear from you. Reach out to us at info@adrenalinex.com and we’ll connect you with one of our experts.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.