What’s Ahead? Banking Experience Trends in 2026

Banking in 2026 at a Glance:

- The branch continues to trend toward relationship and advisory banking

- Continuity across channels matters even more in an era of digital ease

- Employees are becoming the primary way to deliver brand trust

- Differentiation will come from ownable, repeatable experiences, not trend-driven design

- Technology plays a supporting role in empowering people, not replacing them

As competition rises across the banking industry, financial institutions enter 2026 facing well-established but intensifying challenges. Increasing market pressures, evolving customer expectations, and rising consolidation and expansion demand more than simple awareness of market trends. Success hinges on intentional execution, with a focus on where to invest, what to prioritize, and how to show up meaningfully for customers and communities.

Drawing on their work with banks and credit unions of all sizes, Adrenaline’s thought leaders share where strategies are shifting and where focus is sharpening in the year ahead. From the amplified role of brand and branch to investment decisions shaped by disruption and consolidation, these insights reveal not just what’s changing, but how banking leaders are approaching the year ahead with greater focus and meaning.

Customer Expectations Raise the Bar

At the center of nearly every retail evolution is the customer – not simply as a segment or persona, but as an increasingly informed decision-maker whose expectations for experiences are shaped by every interaction. “The most influential person impacting the brand-to-branch experience in 2026 is the customer,” says Juliet D’Ambrosio, Chief Experience Officer at Adrenaline. “Consumers are empowered by AI, taught by Amazon to expect digital convenience, but are seeking guidance and valuing relationships more than ever.”

Influenced by what other retail categories deliver, people arrive at the branch with a baseline belief that their interactions will be meaningful, efficient, and personalized. At the same time, consumers continue to seek out human-centered expertise to help them build greater confidence in their financial lives. That combination of heightened expectations and shifting behavior is a challenge for financial institutions to not just meet, but to exceed. While the pressure itself isn’t new, the impact is hard to ignore, pressuring institutions to ensure in-person engagement delivers real value for customers in 2026.

Continuity From the Brand to the Branch

Institutions are also rethinking what consistency across channels truly means. As customers move fluidly between digital and physical touchpoints, seamlessness and brand-forward experiences are essential. “The question should no longer be ‘does the branch match the app?’ or ‘does the brand experience match the branch experience?’ It’s ‘does the branch feel like another chapter of the brand’s story?’ And does the branch pick up where digital left off?,” according to Juliet.

Monique Rodrigues, Design Director at Adrenaline, reinforces that point. She says, “The branch experience can’t feel disconnected – from the brand, digital channels, and what customers expect.” As digital experiences continue to evolve in 2026, she says, “the problem will no longer be just inconsistent branches, but how branches must behave like physical extensions of the digital experience.” Ultimately, consistency is a strategic advantage for brands, with experiences that feel intuitive, informed, and integrated, without sacrificing local relevance.

Branch as a Center for Advice & Trust

As routine transactions continue to migrate to digital channels, the branch is increasingly expected to support more complex, higher-value conversations. Advisory engagement, wealth discussions, and long-term financial guidance take on even greater prominence in 2026. “The most influential force is how institutions integrate human expertise with intelligent digital enablement at the point of experience,” according to Brad Parrish, Senior Director of Enterprise Design Integration. “Branches must support consultative, advisory-led interactions that compete effectively with fintech and robo-advisor platforms.”

Andrew Johnson, Adrenaline’s Head of Account Management, sees this evolution as a direct response to competitive pressure. He says, “If institutions are losing the deposit war to branchless banks, a shift in strategy by doubling down on in-person experience and advisory is a natural evolution, especially when branches are still showing to be an essential driver of market share.” That shift also influences who branches are designed for. “Everybody wants to attract affluent customers,” says Andrew. So financial institutions must create spaces and hire and train branch employees to have these deeper conversations with targeted customers.

Employees as Brand Ambassadors

As branches take on more advisory weight, the role of frontline employees becomes even more central to how people experience brands. “The branch experience won’t just be defined by tech or design,” says Jessica Rice, Engagement Strategy Director. “It will be defined by how clearly employees understand the brand and how confidently they bring it to life in everyday moments with customers.” With fewer visits and higher expectations in 2026, those human, unscripted interactions matter more than ever.

Consultation and experienced staff aren’t the only attributes that customers seek out in the branch. Keaton Texeira, Adrenaline’s Senior Director of Strategy, points to relevance as a key differentiator. “Clients are often trying to answer, ‘how do we create a unified experience that feels relevant to every generation?,” Internal culture is a fundamental element of that brand experience. Keaton says, “Leaders want branch employees to rally around the brand platform and see it as something that can inspire, clarify purpose, and give staff a sense of pride and direction.”

Tech as a Catalyst for Engagement

Technology, like automation and AI, continues to influence how banks operate, but Adrenaline’s leaders unanimously view it as a support system rather than a replacement for human-led experiences at the branch. “Clients seek a single source of truth for their branch network — what branding elements, furniture, finishes, and devices are deployed, where they are, what condition they’re in, and how to standardize future rollouts,” says Greg Rhoads, Adrenaline’s Senior Director of Technology & Operations. Greg notes that branch optimization is increasingly tied to measurable outcomes, driven by consistency in a compliance-first framework.

Regarding brand messaging, banks and credit unions lean on digital tools increasingly in 2026. “Banks are solving a communication challenge to tell the right story, in the right place, at the right time,” says Bryan Pettit, Senior Director, Digital Account Management. Again, to keep up with traditional retail channels and customers’ expectations, digital signage, wayfinding, onsite scheduling, and digital queuing will all increase adoption in 2026.

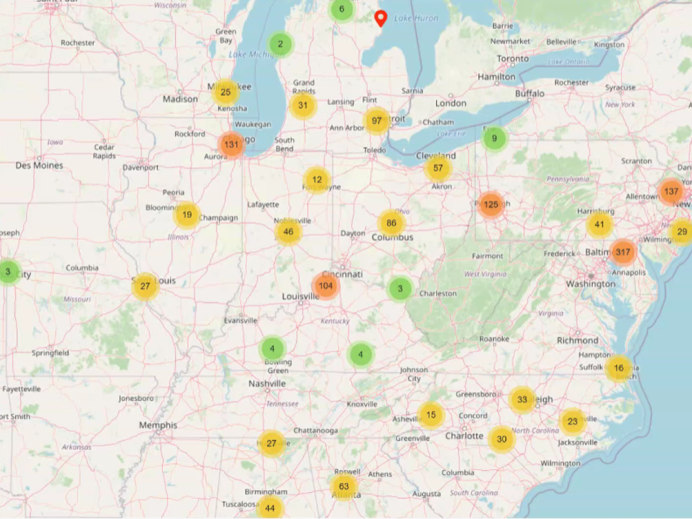

Data continues to be the backbone for bank network optimization. As networks grow and customer needs evolve, data increasingly drives the experience. According to Linda Bennett, Managing Director, Business Development & Partnerships, “Clients big and small are looking for better data-driven strategies regarding their branch network as a whole.”

Designing the Future of Banking

Looking ahead, the path forward for banks and credit unions isn’t defined by a single trend or technology, but engagement shaped by deliberate choices around institutional investment, brand differentiation, and cultural alignment. With the branch still driving the majority of new-to-bank sales, brand experience should be every institution’s core competence. According to Brad Parrish, “Success depends on designing branch environments that support consultative wealth management, complex financial conversations, and trust-based relationships that digital-only platforms alone cannot deliver.”

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.