What Are Your M&A Blind Spots? Insights for Banking Leaders

How branding impacts risk, efficiency and growth in bank and credit union mergers and acquisitions

Branding After M&A at a Glance:

- It’s important to detect identification confusion risk with a brand early enough to address it proactively in M&A planning

- Having a brand that requires deep explanation to consumers and the market robs sales and marketing officers of valuable engagement opportunities

- Smart banks and credit unions are using research to inform how to distinguish, define and differentiate their financial brand in the wake of a merger

With M&A activity picking back up toward the end of 2023, financial institutions of all sizes are assessing their own prospects for a merger or acquisition in the short-term future

Especially important for community banks and credit unions, merger and acquisition activity is often a key driver for growth, allowing financial institutions to increase their influence and expand their organizations. “With a few months remaining in 2023, banking experts see signs of rising bank mergers and acquisitions on the horizon, as financial institutions look for competitive ways to scale,” according to recent industry reporting. Further, banks and credit unions that merge are in a position to “serve more and serve better in communities of all sizes than their individual pre-merger institutions,” according to Believe in Banking.

For executives planning their next merger or acquisition, understanding core areas of consideration during due diligence will help ensure that when an opportunity comes knocking, bank leaders are prepared to answer. “We’ve found that in the thick of M&A, some really important areas can get missed,” says Gina Bleedorn, President of Adrenaline. “That’s why comprehensive planning is so important for success.” One way to prevent costly blind spots is updated marketing intelligence. Pre-merger research can be a crucial safeguard against missing key opportunities or risking problems down the line.

Mitigating Risk

When exploring an M&A opportunity, leaders often come together with each person taking on an area of responsibility based on their expertise. While this is clearly a common-sense approach for dividing the due-diligence work involved in a merger, if something isn’t obviously in someone’s proverbial “lane,” things can get overlooked. One of those gaps is marketing and brand research specific to that potential deal. Even if a bank is familiar with a market, without updated data-based intelligence, banks can discover later that presumptions caused them to miss something important and derailed the plan.

Many institutions don’t detect identification confusion risk with their brand early enough to address it proactively in M&A planning. Even if another financial business doesn’t have an office in the same geographic area, legal and reputational risk still exists and should be taken seriously. If another brand uses comparable branding in look or message or if they use overlapping media and online channels, this can impact brand power because legal and reputational territory expands far beyond branch locations or regulatory borderlines.

Another brand issue often missed by expanding banks is when a similarly-named bank or loan company operated in the market in the past, and prospective customers or members assume an unflattering connection. Although a bank may have to change its name because of a merger, data will help determine if that name still represents a hurdle to overcome, even if it doesn’t turn into litigation. It’s also essential to understand that geography is no longer fixed. Migration patterns, commuting (or not) and demographics have all intersected, shifting our concepts of fence lines.

Even more critical than geographic location is digital footprint. The reality is that digital demands that banks understand they’re everywhere now, regardless of branch locations. As a bank expands, were they aware of another similarly named brand operating in the digital space, now or in the past? A robust data intelligence program helps bank leaders navigate potential conflict or confusion and be well-informed about today, not conditions of yesterday. Insights can also help banks understand and amplify their own brand value, which they can then leverage at the negotiating table.

Driving Efficiency

Data and insights also directly drive efficiency for organizations in expansion mode. By using data, banks ensure their marketing, messaging, campaigns, and communications are targeting elements of their brand story that will have the most power. Further, research ensures financial institutions can make the most of the launch window when people may be more open to hearing the brand story and make it as resounding, relevant and relatable as possible.

While branding may not often be associated with efficiency, having a brand that requires deep explanation to consumers and the market robs sales and marketing officers of valuable time. That means inefficiency – clarifying the company’s identity and story instead of focusing on a prospect’s needs. Especially when it comes to competitive research, banking leaders must consider all of the parameters to make smart decisions about marketing investments.

For branding, banks should leverage a meaningful examination into what parts of their story prospects don’t know, what parts they care about, and what kind of offers will match what people in the growth market need and expect. Institutions may rely on their own knowledge of current customers to maintain those relationships. But what about the people the bank wants to reach in the future who are not current customers – what do those people perceive about a brand? What stands out competitively? Well-designed research programs can tell you that.

Finally, on efficiency, banks that have undergone M&A before may have a checklist – a plan they want to pull out and run again. While experience in M&A is no doubt a good thing, it’s critical to understand situations can be very different, so plans need to be iterative. Using a checklist that has always worked but isn’t modified for current conditions allows unforeseen issues to develop. As organizations plan M&A, they should be keen to include departments like compliance or marketing at the outset to help predict and prevent unpleasant surprises further into the deal.

Enhancing Growth

Future-facing, the whole purpose for M&A is expanding influence and opportunities for the organization. Data can help turbocharge that kind of growth. Smart banks and credit unions are using research to inform how to distinguish, define and differentiate their financial brand in the wake of a merger. Oftentimes when banking leaders are considering marketing and brand research, they think of customer satisfaction data: Do you like our staff? Are you happy? But well-designed research goes beyond satisfaction surveys to ensure organizations aren’t operating on biases and blind spots.

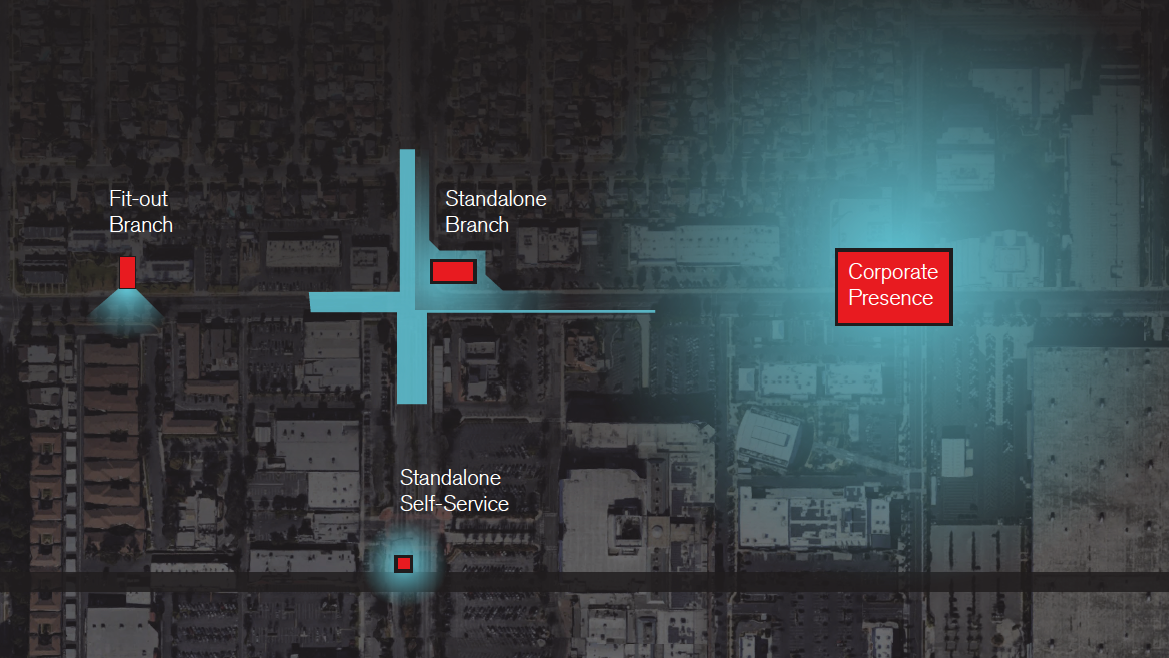

Data-gathering is not just widespread consumer surveys on brand affinity and awareness, either. It can include in-depth interviews tailored to target prospects – like business owners – or focus groups with key consumer groups – like growing families. Brands don’t even have to merge to move into these markets; they could just be growing into them organically. And data can drive smart decision-making the right branches in the right markets. Also, if organizations do research for a new growth market, it can be revealing to do the same research program in a stronghold market to compare and learn.

Bank leaders may be happy with their current positioning in current markets, but data may reveal deficiencies to remediate before growing and going further. Despite being in a market for decades, for example, a bank may not have nearly the brand equity an institution of their tenure should. Or, branding that worked with one generation or culture may have different connotations with a new one. Including research on current branding gives leaders important points of comparison to ensure they’re not making assumptions or missing emerging opportunities. The resulting insights will help banks and credit unions tell their stories to maximum impact, amplifying the brand in both their home and expansion markets.

For more information about bank or credit union branding after M&A, get in touch with Adrenaline’s experts today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.