Turning Visual Experience at the Branch into Real ROI, a fireside chat co-hosted by Adrenaline and BankSpaces, explores the future of the in-branch experience. As transactions continue to migrate to digital channels, the discussion focuses on how branches must evolve from transactional spaces into environments that drive trust, connection, and measurable return on investment.

Here are the highlights of the lively conversation between Gina Bleedorn, President and CEO of Adrenaline, and a recognized industry voice on brand experience, design, and transformation in financial services, and Chris Killian, a veteran journalist and conference producer at BankSpaces. Together, they unpack how data, design, and visual experience intersect to influence customer behavior and long-term value at the branch.

Gina is a featured keynote speaker at BankSpaces in Bonita Springs from April 19-21.

This is an adaptation of the original discussion, which can be watched in full on demand.

Chris: At a recent keynote, you did some live polling and found that around 72% of attendees would still invest in branches even if there were zero transactions in them. It’s an interesting point that shows that bank leaders know their branches need to transform. What does that transformation look like?

Gina: Thanks for starting there because that kind of gets to the heart of it. What does transformation mean? Well, it means branches are getting smaller, they’re getting smarter, and they’re getting more precise based on purpose. So, you don’t need as much square footage on the most part, and that’s probably the biggest shift.

But when I say smarter and more precise purpose, this is about no longer servicing transactions. It’s about first impressions and it’s about advisory. And think about spaces that are advisory led, that are appointment friendly, that are flexible enough to still support transactions but also able to pivot to a life-changing question. And so, thinking about accommodating first impressions instead of transactions is not the way most branches today were built. So, this transformation is, in short, turning on its head the way branch banking has been planned for and done for the last 200 years.

Chris: If transactions are going down and you can do your day-to-day banking on your phone or your laptop, what are the components –maybe one or two – of the more psychologically driven motivations that a transformation leader needs to tend to in order to create the kind of experience that you just talked about?

Gina: In the mind of the consumer, what it matters now is that [they] can walk in somewhere and feel that this place is for me, that it’s relational, and that it’s somewhere where I can have very intimate conversations. [You need to] make sure that the visual experience of your space is saying that immediately to the customer, even before your people say anything. The number one empathetic thing to think about is, “Is this a place where I can get help immediately, effectively, and legitimately?” If someone messes my coffee order, I might have an annoying morning, but if someone messes up my banking it might adversely affect my life. So, banking is a truly underlying, fundamental, emotional, life changing thing and your environments need to say that and support that.

Chris: I love that you brought up empathy because if people are intentionally crossing that threshold to get financial advice, it’s usually because they have a big decision to make, whether it’s a loan or a mortgage or whatever, it necessitates a very empathetic approach from the people who are going to be advising and counseling that person through that process.

Thirty-seven percent of those polled said that branches “make life moments possible.” Can you talk about the role of the brand in delivering on those high-value moments?

Gina: One way to think about it is that people don’t choose banks like they choose sneaker brands or donuts. They choose them almost like they choose partners. And because these life moments are emotional … people need in these moments of honestly, vulnerability, … they need to feel confident, they need to feel reassured that the environment and the people in it have done this before.

Your brand manifests in that environment. And that means everything from the colors to what it says on the wall to what’s coming out of the banker’s mouth is making the customer feel that you are human, that you were intentional, and again that they’re in good hands. Because as we know, bank switching behavior is so low, mostly because of the inertia of the hassle. When you do something in person, even one in person visit can literally transfer someone into a lifetime customer because of how it’s handled or not.

Chris: Moving on to what data you bring into these conversations; Adrenaline does a very good job with in-house research. Can you share an example of data that changed a client’s approach to designing the branch experience?

Gina: To put into perspective the data that matters, community bank Incredible Bank, based in Wisconsin, used data to figure out they had most customers outside of Wisconsin in a major emerging market in Fort Myers. So, that’s market data telling them where to go. They used additional data about best practices and formats that told them to go in with a flagship supported by ITMs.

Consumer sentiment data of consumers in the area, particularly a little older, a little wealthier, showed they want to be able to be serviced at a drive up, but also be very high touch. So, we created quite literally based on all that data, a massive drive-up oriented branch. It’s a big portico share, which is basically like a big canopy. Be where customers receive curbside service.

Let’s go from [an example with] a couple dozen branches to a couple thousand branches with PNC, another [Adrenaline] client. Consumer sentiment data about marketing in their branches helped them realize, to streamline the number of messages, they needed to focus on digital signage as the primary vehicle because static is getting lost. Further research showed that even after merchandising and marketing is done well, the rest of the visual experience [must be] cohesive or consumer sentiment dives. Versus, “this environment feels like a place for me, a place where I want to stay.” That has led to a more of a focus on visual experience for PNC.

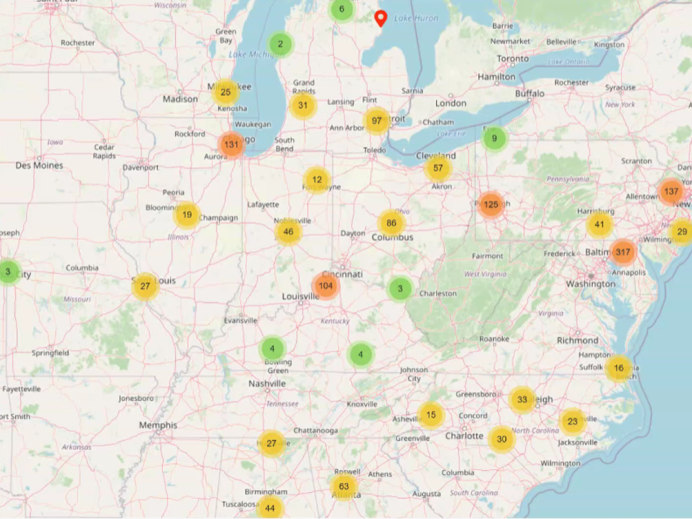

Attendee: Some markets are opportunity markets, some markets are just flat, but you must be there. How do you identify that by market by market and what data do you use?

Gina: We leverage Curinos (Adrenaline’s data partner) and they use multiple data sources from the FDIC and other places that advances them algorithmically into a lot of intelligence that then we use to help create applied strategy. The main things to think about are performance versus potential. When you think about a two by two of performance versus potential, think about there’s some markets you may be killing it and over performing, but there is no room in that market for additional acquisition or cross sell. You do not want to overspend in those markets. There are other markets where you’re high performing, high potential but always keep spending because if you don’t, others are going to come in and outspend you. So, there’s a defensive play even if you’re winning, if there’s potential.

But if there’s potential and you’re not winning, those are usually your priorities for making a change and some kind of action. That means you don’t have enough density, you’re in the wrong location, you’re showing up the wrong way, your branch looks bad, etc. And then when you have low potential and low performance, those are considerations for either consolidations or downsizing. Really the main overlay and then there’s a sub overlay of how what is your density. When you reach about 6% of critical mass in any given micro market or market, your chance of your branch share, your market share outperforming your branch share double, so you want to reach that critical mass.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.