The branch is where banking relationships are started, strengthened, and sustained

Customers use the branch more than any other channel to get advice, solve problems, open accounts, and purchase new products. Data shows that having access to a local branch is the second most important factor for customers when choosing a primary bank. Even younger generations known for being digital-first are visiting branches to get guidance and gather information.

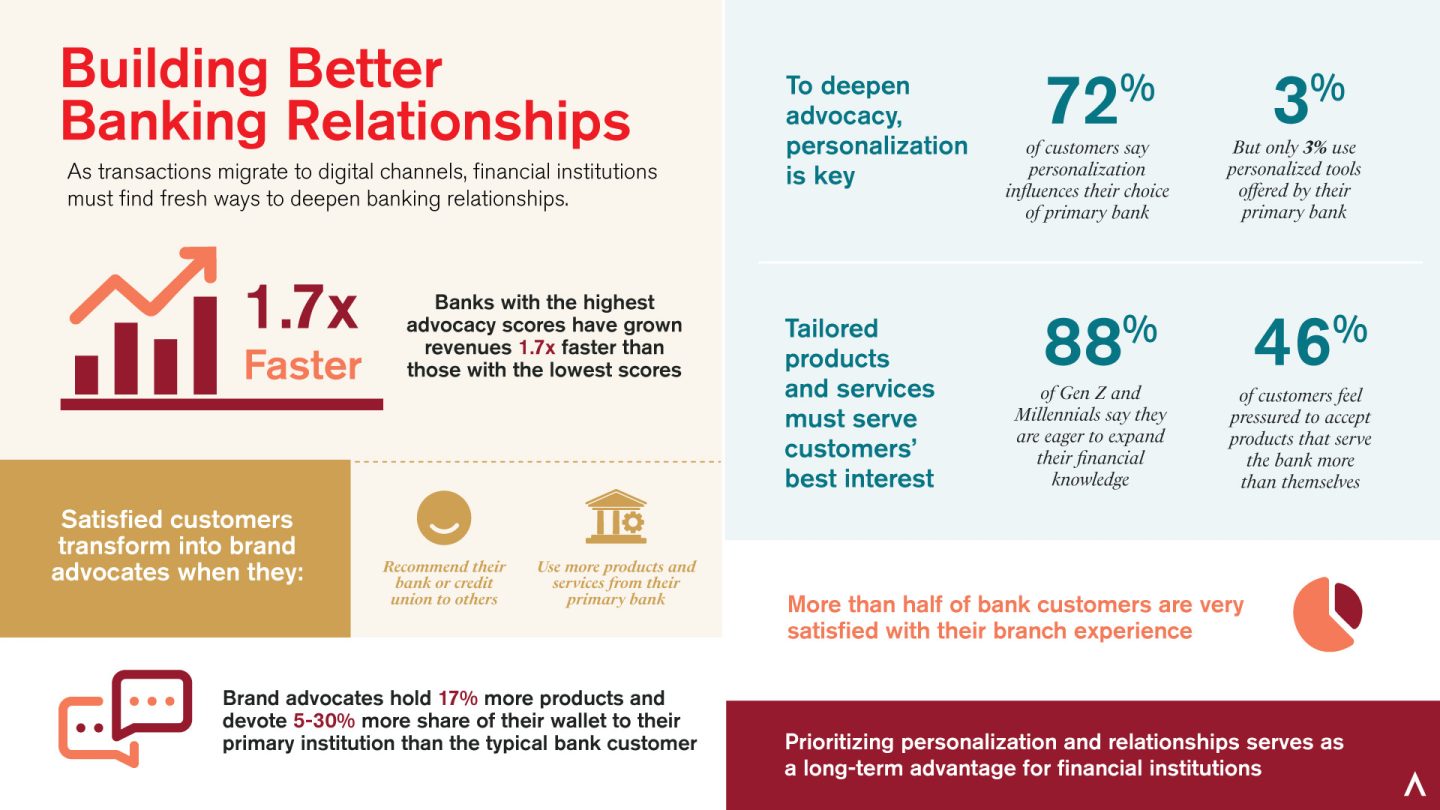

It’s well known that a positive experience at the branch can improve customer satisfaction, but great branches aren’t enough to keep consumers coming back. As transactions continue to migrate to digital channels, financial institutions need to find fresh ways to deepen banking relationships. This includes pivoting the branch to be a hub for financial advice, consultation, and connection. The customer experience must be fully optimized, personalized, and primed for relationship building.

Designing a Customer-Centric Experience

47% of banking customers say the ability of a financial institution to meet all of their needs is an essential attribute. That means access to quick and easy digital channels is important, but access to a human is even more influential. Customers are tuned in to how well their bank or credit union supports bankers at the branch. If the customer perceives that a banker isn’t equipped to handle their needs effectively, that’s a black mark on the brand.

To create more customer-centric experiences, financial institutions should:

- Build trust – Provide full transparency about how consumer data is stored, used, and kept safe. Communicate clearly and often about fees, disputes, and application status.

- Make contact easy – When a customer has an issue, they want quick, friction-free resolution. Don’t keep them waiting on phone or at the branch. Provide bankers and customer service agents with access to chat logs, call transcripts, and other activity so that the customer doesn’t have to reexplain their situation. Better yet, equip all employees with the tools, training, and ability to solve problems without routing the issue to multiple people.

- Customize offerings – 46% of bank customers report feeling pressured to accept products and services that serve the bank more than themselves. Understand the needs of the customer and offer customized products, services, and solutions to meet those needs.

- Optimize branches – Bank and credit union branches should prioritize relationships, making the customer feel valued from the moment they walk in. With transactions shifting to digital channels, branches are becoming a space for more collaborative experiences with fewer barriers impeding progress.

The more a bank focuses on streamlining, personalizing, and enhancing experience, the stronger the banking relationship becomes.

Creating Brand Advocates

An advocate loves their primary bank or credit union enough to recommend it to others. They also use 17% more products and services from their primary financial institution and dedicate 5-30% more share of wallet to this institution than the typical banking customer. Not only do brand advocates buy more from their banks, but they are also more inclined to remain loyal to them as well. Customers who are satisfied with their banking experiences are six times more likely to stay with their primary bank than dissatisfied customers are.

So, how can banks and credit unions turn customers into advocates? According to Accenture, financial institutions “need to build, across all touchpoints, the ability to communicate with each customer in ways that show the customers that they know them well, and that they care about their financial future.”

Personalization is Key to Connection

To deepen brand advocacy, personalization is key. 72% of customers say personalization influences their choice of primary financial institution, but only 3% use the personalized tools offered by their primary bank. J.D. Power’s Retail Banking Advice Satisfaction Study found that only 42% of banking customers “recalled actually being given guidance and advice, suggesting that much of what’s offered is so generic that it doesn’t register.”

There is a clear disconnect between what customers want and what their banks think they want. Financial data leaders agree, with 23% saying they don’t currently leverage data about customers’ financial journeys to personalize recommendations and 60% saying their organization still uses customer data the same way they always have.

A truly personalized customer experience is not a series of isolated interactions. To bridge the gap, financial institutions need to foster continuous, consistent engagement that meets consumers where they are and genuinely aligns with their needs.