Banking Fundamentals 2025 at a Glance:

Returning to banking fundamentals is a strategic advance that prioritizes operational excellence, customer trust, and sustainable growth. Focusing on fundamentals emphasizes building resilience through proven practices while maintaining the agility to innovate thoughtfully within a strong foundational framework.

- Prioritize operational excellence as a competitive advantage: Focus resources on perfecting core banking functions like customer service, risk management, and operational efficiency that drive long-term success

- Lead with human-centered service delivery: Maintain empathy and exceptional customer experience as non-negotiable elements even when market conditions shift

- Measure success through fundamental metrics: Track customer retention, operational efficiency, and satisfaction scores

- Build innovation on stable foundations: Use strong fundamental practices as the platform for selective technology adoption and service enhancement

While AI continues to rise, banking experiences remain a core focus and the branch endures the locus of growth in the new year

As banking takes on a new year, what are the major trends and themes experts expect in 2025? Surely, transformative technology will continue its outsized impact on the industry, as advanced generative AI solutions become more effectively operationalized by financial institutions. “Big banks like JPMC, Morgan Stanley, and Truist all found back-office tasks that could benefit from the tech,” according to Tearsheet’s 2025 trends report. “Some small but forward-thinking banks are realizing that building AI literacy and capabilities in their workforce is essential and launching strategies that help their workforce upskill.” While technology generates buzz in banking, most institutions still need to sharpen their focus on fundamentals to be competitive.

As banking experiences continue to evolve, growth-minded financial institutions are working hard to keep up with updated design and delivery models. “I find myself thinking about how much of the branch experience is changing, but also what has remained unchanged,” says Chris Howe, Design Principal at Adrenaline in the company’s exploration of What’s in Store for Banking in 2025? “I believe Will Guidara’s delivery concept of unreasonable hospitality is on point as a major influence on service retail globally, including financial services, where service retailers will deliver exceptional in-person experiences by being hyper-focused on human connection and building loyalty through trust.”

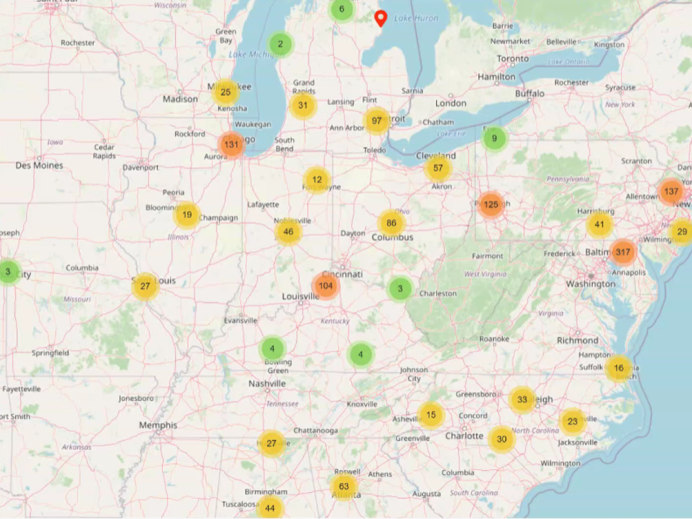

The branch remains the locus of growth for most banks and credit unions, so it only makes sense that we’ve seen such a surge in branching over the last year – something that’s expected to continue into 2025 and beyond. “From new market entry to existing footprints, branch experience reigns supreme and investment is surging,” according to Adrenaline’s President and CEO Gina Bleedorn. As the branch experience emerges as a real advantage for banks and credit unions, Gina expects branch investment to generate gains for financial institutions. “The results will be an ability to meet the competition for acquiring and retaining customers, as banks more aggressively double down on branch transformation.”

If you’re a banking leader looking to serve more and serve better, get in touch with the banking experts at Adrenaline.

Believe in Banking is Adrenaline’s insights-led resource, created to inform, educate, and inspire leaders in financial services. Delivering credible content rooted in research, the platform highlights the forces shaping the future of banking. From perspectives on emerging trends to podcast interviews with industry trailblazers, this purpose-driven channel helps banking leaders learn, lead, grow, and thrive.