Bank Mergers & Acquisitions at a Glance:

Bank M&A is closing the year on a high note, signaling a wave of strategic growth ahead. End-of-year deal value has tripled, with four transactions over $1 billion announced, and research shows one-third of bank leaders are now “active acquirers.”

This momentum is more than a year-end trend: it’s a signal to move. Banks that act decisively can secure scale, technology capacity, and market share before competition heats up in future years.

- Align scale with strategy: Focus on deals that support long-term goals, whether investing in technology or expanding your geographic footprint (as 43% and 37% of leaders are doing, respectively, per a recent survey), focus on deals that support long-term goals.

- Use mergers of equals strategically: Position MOEs as a competitive lever, combining strength while staying agile against larger players.

- Capitalize on community advantage: Credit union acquisitions keep branches open and preserve local ties – a differentiator for customer trust.

- Plan for 2025 now: With 43% of bank leaders expecting to acquire another institution next year, act early to secure the best opportunities.

Executives at financial institutions of all sizes increase their interest in inking more bank M&A deals in 2025 and beyond

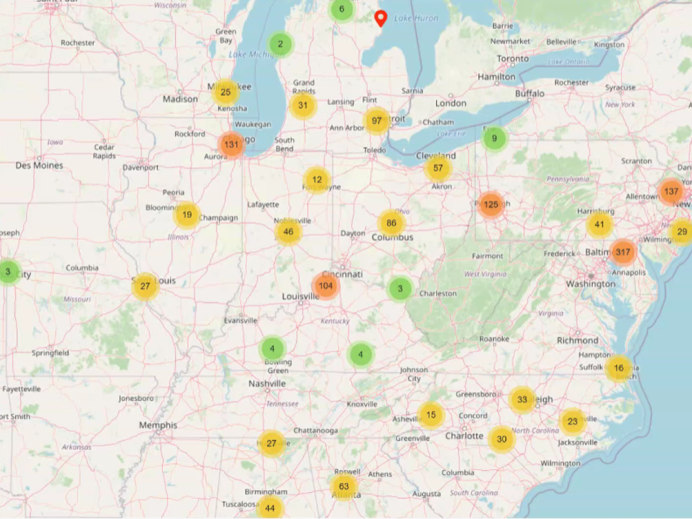

Growth remains top of mind for banking leaders as they seek scale to stay competitive into the next year. That’s why one-third of executives classify themselves as “active acquirers” in the new 2025 Bank M&A Survey. According to the research by Bank Director and Crowe, “Forty-three percent of bank leaders say their organization is very or somewhat likely to buy another bank by the end of 2025, up from 35% a year earlier.” The leaders surveyed cite scale as their primary consideration – especially in growing technology and other investments (43%) and geographic expansion (37%) – driving their merger and acquisition strategies.

Not only are bank executives interested in merging or acquiring, but the deals are delivering more value than ever before, reaching record levels at the end of 2024. As the year closes, S&P data shows that bank merger and acquisition value has tripled this year, with four $1 billion-plus deals. “M&A advisors expect momentum to endure following Federal Reserve interest rate cuts — by 50 basis points in September and 25 basis points in October — as falling rates are expected to lower borrowing costs and minimize credit quality issues,” according to American Banker. “For acquirers, this simplifies the process of evaluating sellers’ health.”

Regional banks are increasing their attention to bank mergers and acquisitions as a way to mitigate risk. “Regional lenders at the heart of last year’s banking crisis are cutting more deals to shore up their balance sheets and compete with rivals,” according to Reuters reporting. However, an extensive wave of consolidation in the regional banking sector may cause more regulatory scrutiny. According to Reuters, “The regional banking sector has come under immense pressure as elevated interest rates have dampened borrowing, increased competition for deposits and led to larger losses on commercial real estate loans, forcing banks to scale up and diversify”

For community banks, their path to growth remains the primary driver for banking M&A. Mergers of equals have delivered positive outcomes for smaller institutions seeking scale. “One of the main issues community banks must grapple with is the technological capabilities large financial institutions maintain due to their capital resources,” according to an S&P analysis of a 2024 Wolf & Co report on community bank mergers and acquisitions. “However, the recent merger of equals activity suggests that community banks are seeking to close the gap.” Even more, additive style mergers will not raise regulatory concerns, particularly if service areas are expanded as part of the deal.

If you’re a banking leader looking for effective brand strategies after M&A, get in touch with the experts at Adrenaline.

Believe in Banking is Adrenaline’s insights-led resource, created to inform, educate, and inspire leaders in financial services. Delivering credible content rooted in research, the platform highlights the forces shaping the future of banking. From perspectives on emerging trends to podcast interviews with industry trailblazers, this purpose-driven channel helps banking leaders learn, lead, grow, and thrive.