Using the North Star approach, banks now have a process for evaluating internal and external forces of change and strategically deploying enhancements to the branch network. With expectations trending up and size trending down, banks have quite a lot to live up to. Unlike the early days of banking, branches are no longer just a cookie-cutter facsimile of one another. Today, bank branches have diverse format and footprint requirements determined by a whole host of factors.

While central branding elements will create a cohesive visual feel, each bank branch should ideally represent both a size and scope to best serve the local market’s banking needs. That means some branches will be downsizing, while others will be expanding their operations. In determining which formats to roll out in which areas, what banks are really doing is balancing expenditure and experience, ideally determining the minimum spend to achieve the maximum results for each location. Some of these branches will be retools and other ground-up builds, but regardless of format, banks will find that as size decreases, zones of experience overlap and require more radical shifts in design and staffing.

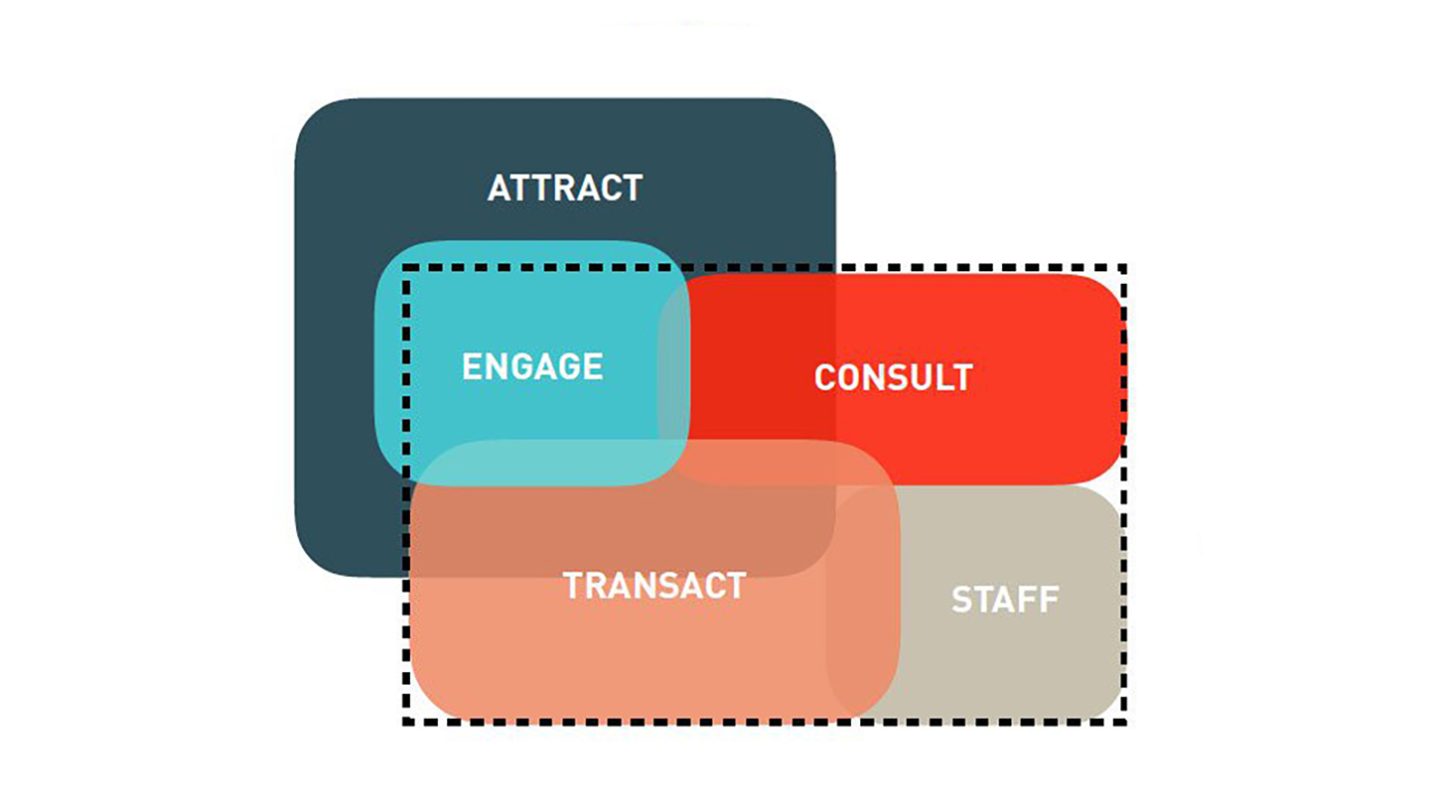

Each bank location has Attract, Engage, Transact, Consult and Staff Needs zones critical to the functioning of the branch. Attract serves as a beacon for returning and potential customers. Engage is where customers are greeted and begin their in-branch journey. Transact is where consumer banking activities, like deposits and withdrawals, take place. Consult is where customers get financial advice and counsel from experienced team members. Finally, Staff Needs is a non-customer facing space for back-of-the-house activities. Two particular branch types, the Micro and the Cashless formats have tightly managed zones of experience and focus on maximum efficiency while serving the community.

Scaling Up

Whether a bank enhances an existing network of branches or expands to new markets via merger or acquisition, leveraging its North Star – the always-iterating, ideal branch experience – is central to optimization. When updating existing networks or transforming new branches, there are two core categories of enhancements: visual and operational. Visual upgrades range from in-branch branding and communications to design elements like upgraded interior finishes and furniture. Operational enhancements, on the other hand, are more far-reaching and require deeper investment since they incorporate both visual elements and functional capacities, to transform how a branch operates.

The visual modifications tend to be more transitional changes in how a bank looks. The operational shifts are more 360-degree transformations in how a branch operates. Working with banks to maximize their physical channel, we are finding that approximately 80 percent of financial institutions fall into the transitional category. They want to maintain their local community presence through local branches but don’t want or need a massive overhaul at this point. These banks really just need to make progress and unify their network. This is beyond just refreshing the visual elements to bring it in-line with the brand, but doesn’t go as far as revamping all of their practices and processes.

In our next installment on network optimization, we will address the range of enhancements available and the applicable budgetary tiers. Whether it’s a simple refresh, an intermediate transition or a transformative overhaul, bank brands can seize enhancement opportunities that are the right fit for them. The major focus will be real-world, visual examples of enhancements and their real-world costs – the most popular part of any of our presentations – to demonstrate the potential, precedent and practice for each tier.

To talk with one of our network optimization and transformation experts, contact us at info@adrenalinex.com.