From zones of experience to tiers of transformation, change deployment across the physical channel represents one of the biggest challenges facing the financial services industry. In our third chapter in the branch network transformation series, we are taking a look at the range of enhancements available to banks and what those upgrades will mean in terms of budgetary spend. We will provide best practices and real world examples for every tier – whether you are refreshing, transitioning or transforming locations.

Often when banks are considering change to their branches, much emphasis gets placed on full transformation, rather than on the steps building up to a complete overhaul. That’s because transformation is more blue-sky thinking – focusing on what could be in the future rather than what should be in the next few months. Realistically, 80% of a bank’s efforts for branches are in this transitional phase. Through acquisition or atrophy, the sheer volume of branches in need of an update could overwhelm any brand. Realistically, it’s just not viable from an economic or efficiency perspective to completely transform all of those spaces. What they need is progress – a transitional, tiered approach.

Visual vs. Operational

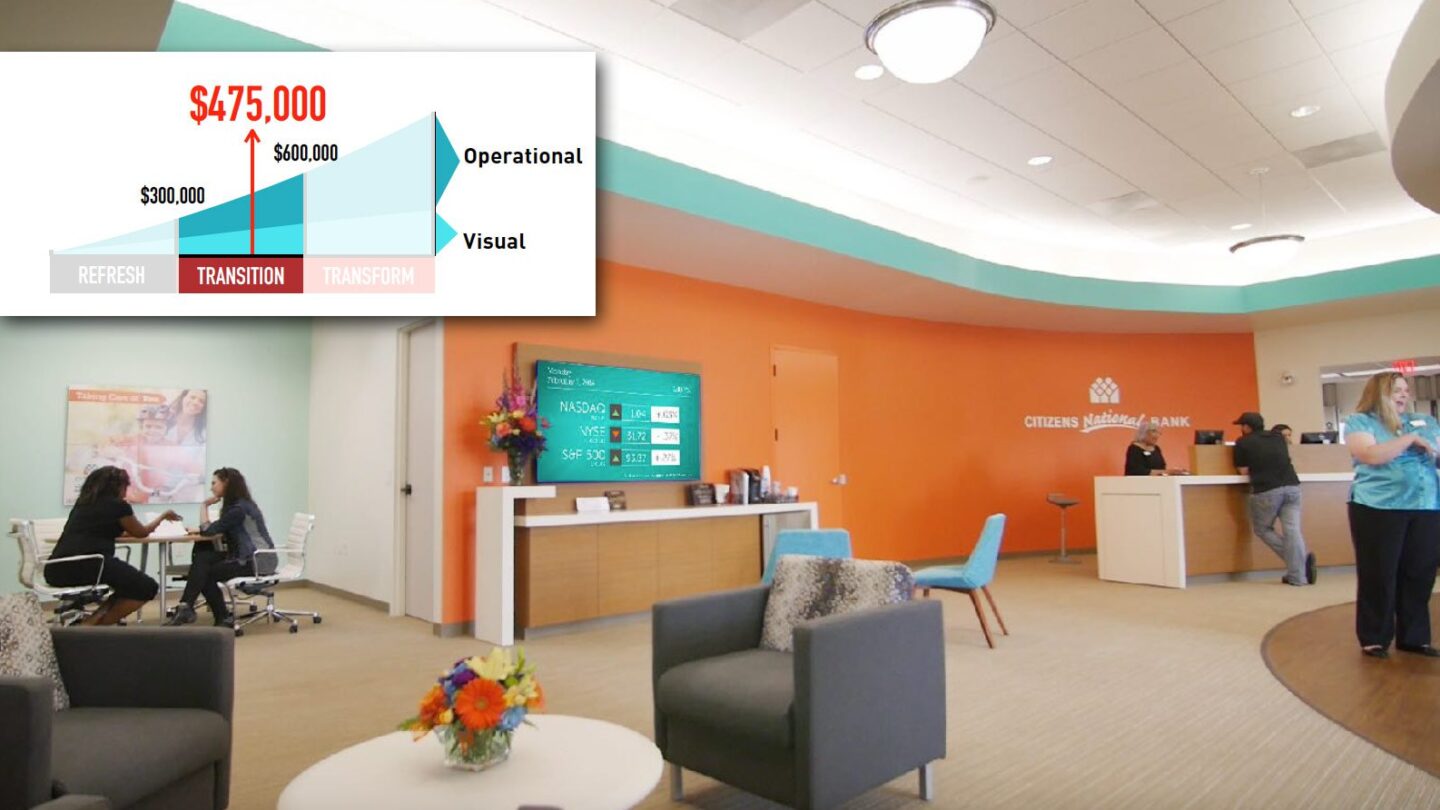

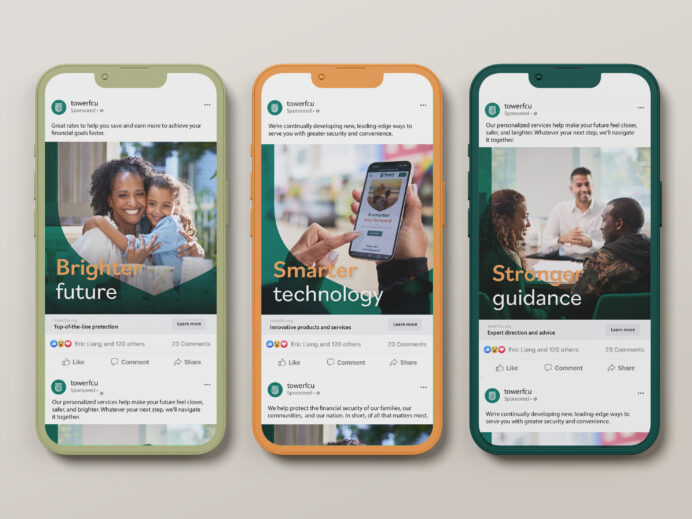

Visual change in branch networks trends toward more surface-level elements. Signage and other forms of visual branding, along with furniture and finishes, can provide an upgrade and alignment to brand standards within a more manageable budgetary range. Operational enhancements then build upon the visual elements to usher in transitional change that align with the visual begins to address the form and function of the branch. Finally at the transformational level, the focus is on truly optimizing business models through network efficiencies – including staff roles and responsibilities, branch activities and transactions, and backend procedures and processes.

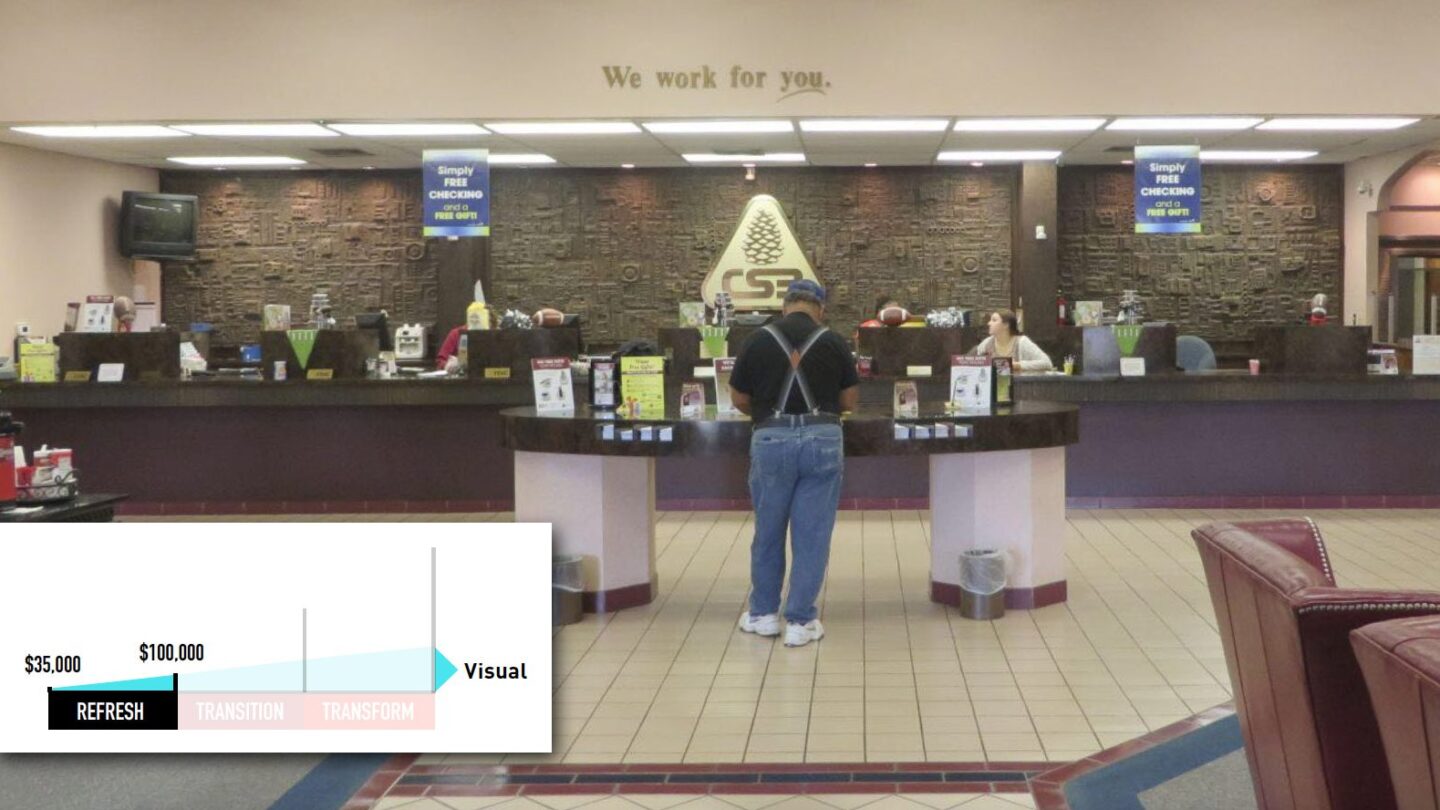

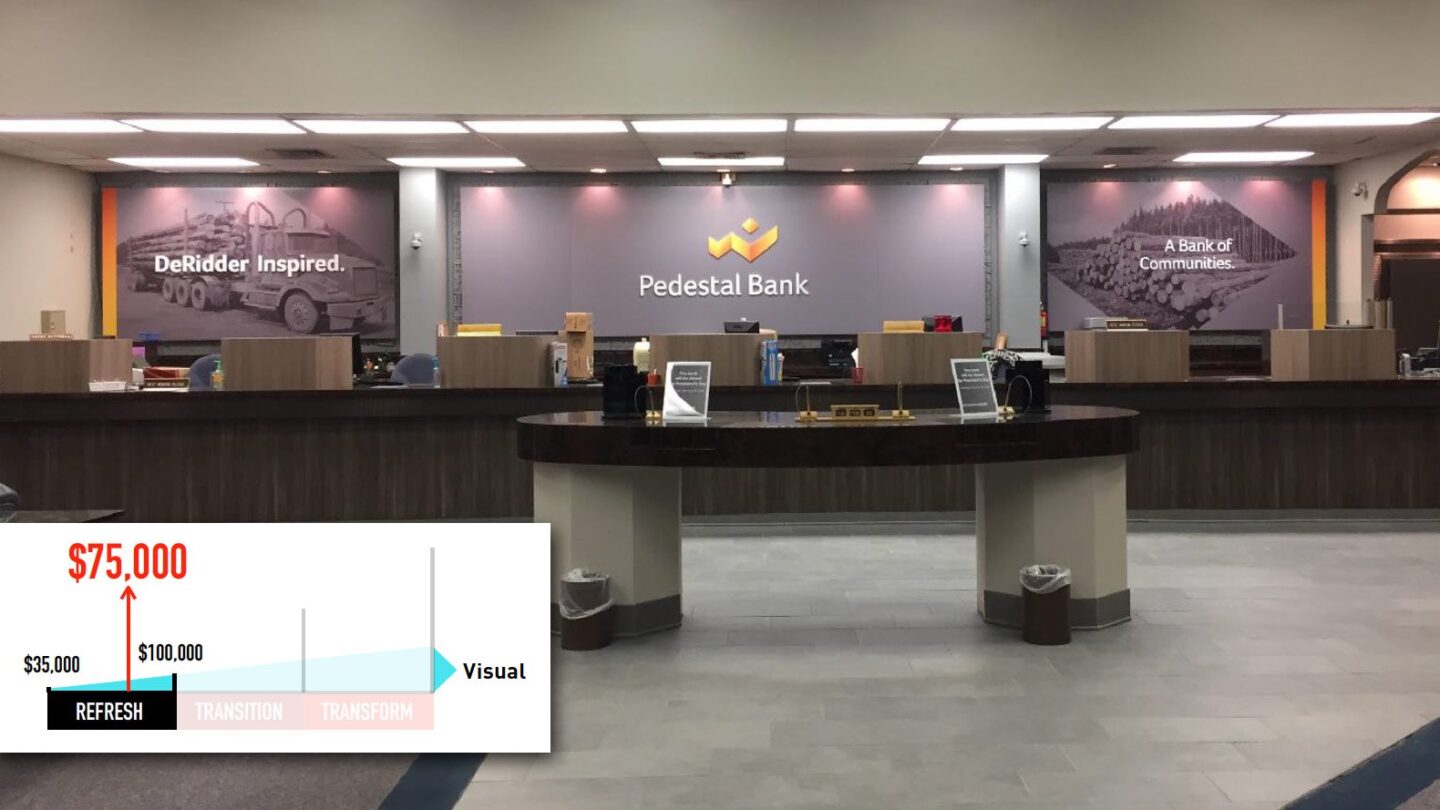

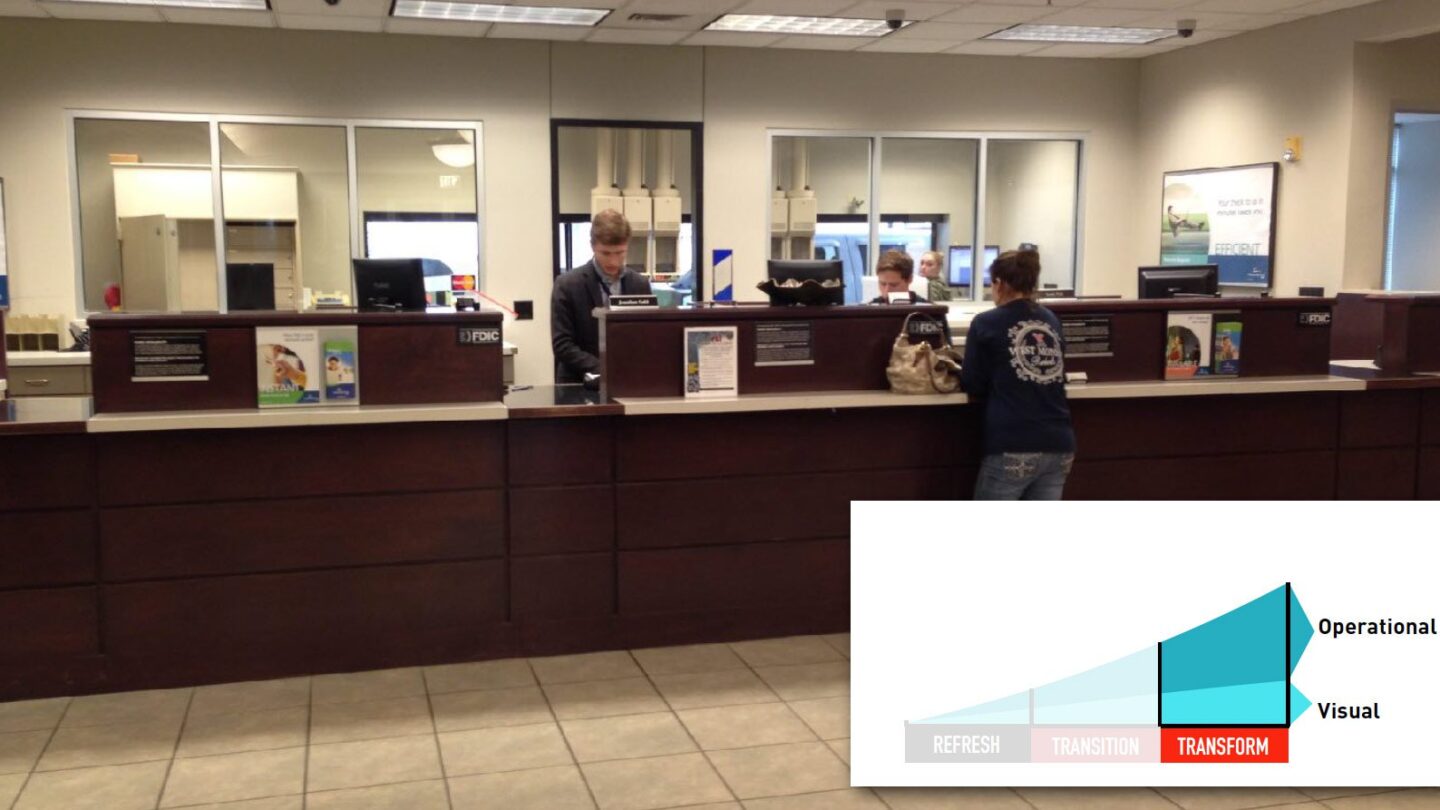

As banks consider the practical realities of optimization, lower budgetary spend trends toward the visual elements – exterior signage and interior design. While lower financial investment is required at the refresh tier that doesn’t mean those revived spaces don’t pack a punch. Updating visual elements alone – like lighting, flooring and color palette – can have a dramatic effect on how a space feels. In transitionary enhancement, the budget incorporates visual upgrades as foundational, while functionality is assessed and augmented. With transformation, higher budgets allow for a space to be completely reshaped, incorporating new zones of experience and operational efficiencies.

Refreshed spaces include updated color palettes and modern finishes.

Pedestal Bank

Transitional spaces use the same footprint, but begin to shift not only how the space looks, but how it functions, introducing new zones of experience and taking away those areas that don’t function well.

Citizens National Bank

Transformed spaces are a wholesale reimagining from top to bottom. These spaces look, feel and operate differently than ever before.

Origin Bank

If given a choice, most managers would love to usher in all new transformed spaces in every location. Since dollars for branch optimization don’t flow endlessly, how do bank brands decide which locations to refresh, transition or transform? In our final installment on Optimizing + Transforming Your Branch Network, we will address how banks make these decisions. Specifically, we examine how analytics are being used to drive priorities and determine how to allocate tiers throughout the network. In this era of big and small data, analytics have become a powerful means for aligning branch investment with potential and purpose.

To talk with one of our bank optimization and transformation experts, contact us at info@adrenalinex.com.