Branches are the focus of much of the mission-critical decision-making in banking today. Following cost-cutting closures in recent years, a growing number of banks are beginning to execute expansion plans instead. That’s not surprising with six out of ten consumers continuing to visit local branches. In addition to branch expansion plans by Chase, Citi, PNC, BofA and others, increasing M&A activity has financial institutions needing to implement a cohesive and consistent conversion of their branch networks.

In the Financial Brand’s Avoiding Branch Rebranding Headaches in Mergers and Acquisitions, Adrenaline’s President & CEO Gina Bleedorn and Chief Delivery Officer Frank Beardsworth share their thoughts on branch rebranding. “Interactions in branches have a heightened importance and value,” according to The Financial Brand. “They help shape experience and guide consultative selling.” Expanding on concepts in the article, Gina says, “Branch interiors truly impact advocacy – certainly of customers, but also of your staff. In integration and conversion, it’s critical your staff buys into the new brand and the new experience inside.”

The Financial Brand summarizes the complex process this way: “Inside is where the transformation gets really specific. Adrenaline estimates up to 45 different customer-facing elements in a branch that need to be taken into the new corporate brand.” Given that many financial institutions have never undertaken a branch rebrand of this scope, developing an operationalized approach is necessary for success. Gina says, “Clients are looking for effective strategies to balance cost and timing with quality and brand integrity. It’s achievable, but you need partners with experience in this type of planning and prioritization.”

Though the article, and Branch Rebrands & Conversions After M&A insights, provides guidance on principal considerations – including investment tiers, an outside-in strategy, and cultural alignment – one thread ties it all together. Managing myriad elements is essential to a successful rebrand. “With hundreds of assets to align, reconcile and rebrand, it very quickly becomes a mammoth undertaking,” says Gina. “What people need is some sort of easy button for rebranding the branch experience.” A platform like AMP is what Adrenaline uses to 1) holistically document 2) analyze and assess and 3) create a plan for reconciling with a kit-of-parts.

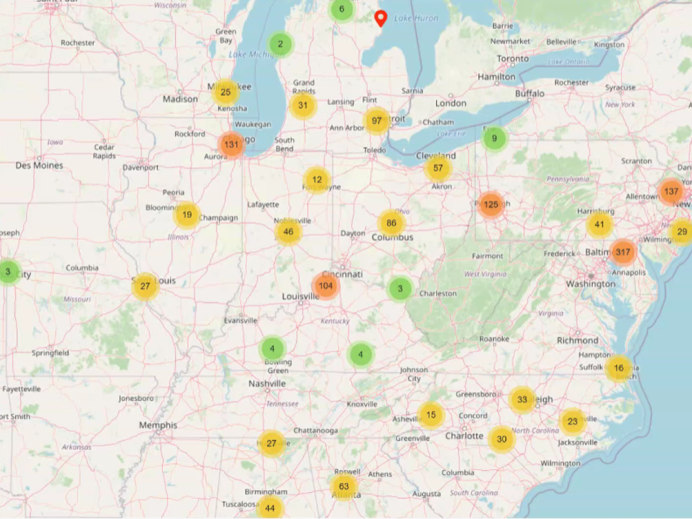

This kit-of-parts approach, managed inside a robust and real-time platform, has worked for thousands of branch rebrands – with organizations ranging from national and regional banks to community institutions. “We’ve seen many banks use M&A as an opportunity for long-overdue updates to their entire branch network, but organizing this process can be a beast,” according to Frank. Once investment decisions are made based on performance and opportunity, documenting the current state and all physical assets is next. “You need to navigate the inside of branches on a detailed level, like a version of Google Maps street view for the outside and the inside of the branch.”

A platform that organizes the process is not just for design to document and deploy. It’s also a communications vehicle where key stakeholders can collaborate and coordinate decision-making and benchmark progress. “Choices and customization can be really complicated, especially when you have so many people involved in a branch rebranding process,” according to Gina. Getting eyes on branches for quality control without ever walking into locations is possible thanks to technology. “From on-site branch managers to remote members of the C-Suite, getting everyone on the same page and facilitating as minimal disruption as possible is really essential.”

For a powerful example of branch conversion featuring Adrenaline’s client First Horizon along with all of Gina and Frank’s insights on the branch rebranding process, see The Financial Brand’s full article Avoiding Branch Rebranding Headaches in Mergers and Acquisitions.

To learn more about successful strategies for branch conversions and refreshes, or to speak with one of Adrenaline’s experts, contact us today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.