Despite competition from inside and outside the industry, most healthcare institutions are struggling to keep up with consumer demand for better experiences.

In fact Kaufman Hall’s 2019 study the “State of Consumerism in Healthcare” finds that a huge proportion of hospital health systems – 88 percent – report that their organizations are not ready to contend with consumer-friendly options coming from non-hospital entities, including big retail like Amazon and CVS, technology companies and app developers. Realistically, consumer retail is what continues to set the pace for other industries to follow. As consumer retail expectations continue to rise, many in service retail – like healthcare – trail behind.

Interestingly, another study looking at just one just area – mobile – finds that many providers are not even meeting consumer demand here, much less exceeding it. The study by digital solutions provider SOTI finds less than 60 percent of physician practices are offering mobile access for appointment scheduling, reviewing lab results and diagnostics, even though it’s clear that mobile access would enhance the consumer healthcare experience. In this study alone, 75 percent of consumers report they believe that physician practices deploying mobile technology provide a more efficient and convenient service for patients, including a reduction in wait-times and a greater adherence to treatment plans.

Inside the clinic setting, we’re witnessing major initiatives to begin remaking the customer healthcare experience. Some of these programs are coming from companies making inroads in healthcare delivery – CVS, Walgreens, and Walmart – which are upgrading care in their clinics. Other advances are coming from medical technology companies to treat common diseases like diabetes in a novel way. What surprised us is the volume of advances led by some of the country’s more conventional health companies – Humana, United Health, Kaiser Permanente – which are focusing on teen and senior health programs and partnering with other non-medical companies like Target to extend their reach.

Consumer Centricity

In this industry snapshot, what we’re seeing unfold is a move away from healthcare solutions for the provider towards a model of healthcare delivery created and curated for the consumer as organizations glean best practices from consumer retail. Previously, most advances from healthcare organizations were focused on a technology fix to solve their own institutional problems, but now we’re seeing healthcare follow consumer retail’s targeted delivery model. The benefits retail often sees from adapting to consumer demand – consumer centricity – may well provide efficiencies to the brand itself, but that’s not its primary function. Its focus is squarely on meeting and exceeding consumer demand.

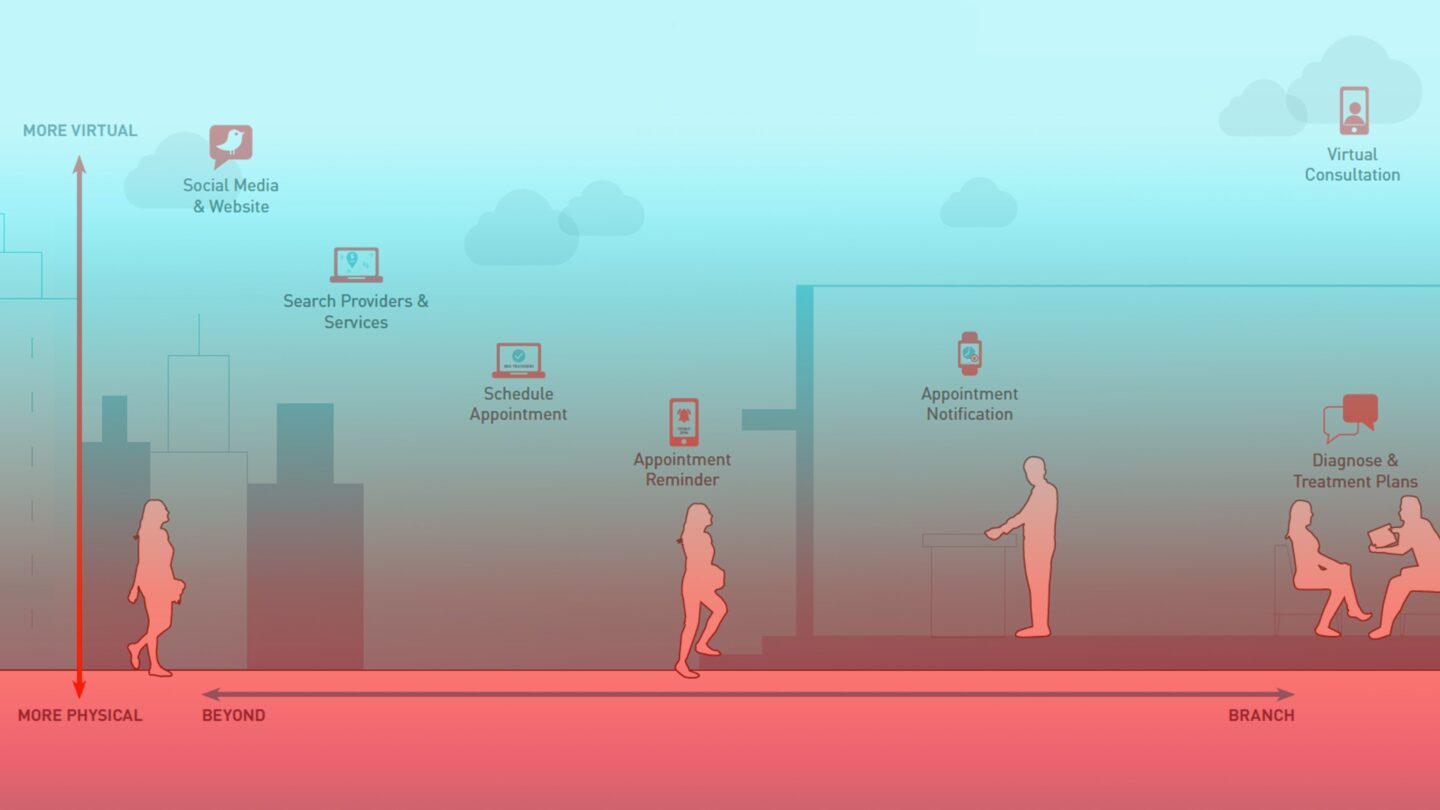

We all know that product retailers provide things consumers want but perhaps may not need, like a larger, even flatter screen television. Conversely, service retailers provide solutions that consumers need but may not want, like a regular wellness visit or an annual screening reminder. While you may not look forward to your annual primary care visit, there are things that can make the healthcare experience better, more convenient and based around you – the healthcare consumer. With consumer centricity, we are seeing new technologies that anticipate needs, provide accessibility or awareness and balance delivery across digital and physical touchpoints.

As we all know, healthcare is both complicated and personal. Decisions around where consumers fall in the cycle of wellness and how the healthcare provider makes decisions about levels of acuity – what’s most pressing – has a direct impact on the retail delivery of healthcare and the consumer’s perception of care. The healthcare industry must evolve to remain relevant, and it’s not necessarily digital disruption that will shift the landscape. Rather, through meeting expectations of choice, mass-customization and immediate availability of consumer information, healthcare service retailers are building consumer centricity into their organization’s DNA and delivery model.

In our next installment on emerging expectations in healthcare, we will take a deeper dive into examples of change agents in healthcare and how organizations are using innovation to achieve more consumer centricity.

For more information on our experience design services for healthcare organizations or to talk with one of our experts, contact us at info@adrenalinex.com.