Even as digital convenience in banking climbs, consumers continue to value expertise and guidance they can only get at the branch. The dual realities of convenience versus consultation are profoundly shaping how financial institutions design their branch networks and deploy their staff for support. Branches remain key to creating connection and confidence among consumers, even if people visit less frequently. For financial institutions, this is a clear call to action. “Banks have got to think about how to run smarter, not just harder,” says Adrenaline’s Gina Bleedorn in her recent Future Branches keynote. This message reflects the realities of balancing consumer expectations and the unprecedented need for reinvestment in the branch.

Evolving Expectations

Fortunately, financial institutions are answering the call. Across the country, banks and credit unions are ushering in a new era of branch modernization initiatives through large-scale investments into their networks. Wells Fargo is renovating its entire branch system, while Bank of America plans for 165 new financial centers by 2026. Always an industry innovator in branching, JP Morgan Chase is moving forward with its plans for 500 new branches and 1,700 renovations in opportunity markets, both big and small. These three players alone represent nearly 13,000 branches in cities and towns across the country.

This wave of activity raises the bar in every market and spotlights a shift toward a more purposeful, advisory-based model for the branch. In today’s landscape, the branch is not only surviving, it is rising in influence. Branches today are evolving into more purposeful strategic assets in a competitive and rapidly modernizing industry.

- 75% of people say access to a local branch is crucial

- 86% of people have visited a branch in the past year

- Branch-originated accounts drive much higher 12-month retention rates than digital-originated ones

Though people may not come to the branch as often, each visit now carries greater weight for the customer or member AND the institution. The quality of branch experiences is more influential than ever for starting and sustaining banking relationships. For institutions, the branch is at the center of growth.

Market Pressures & ROI

Industry consolidation adds even more urgency to network planning. A surge in M&A activity has reshaped market footprints and impacted real estate availability, especially in dense urban environments. These forces put pressure on banks to design and deliver on tight timelines. Reflecting on consolidation and competition, Gina says, “It is accelerating the pace of modernization,” underscoring how banks and credit unions must transform faster today than ever before. At the same time, not all expansion delivers ROI. According to data from Curinos, 56% of de novo branches fail to reach profitability, which highlights the need for precise market selection, flexible formats, and clear role for each new location within the network.

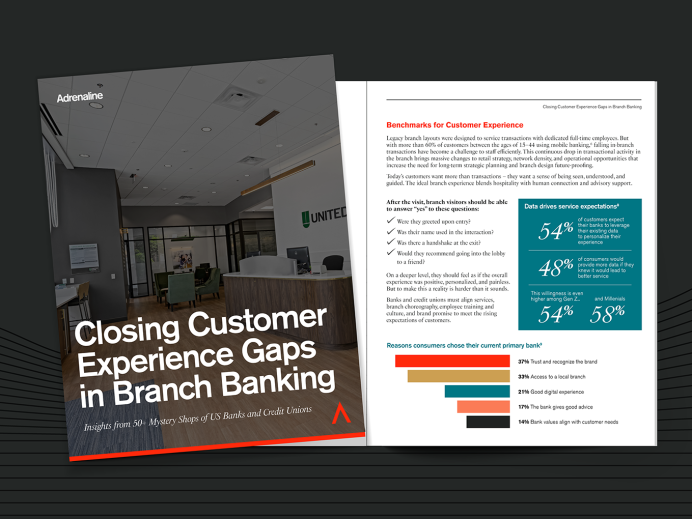

Despite increased investment, many institutions still face gaps in delivering on expected experiences. In this regard, Adrenaline’s mystery shopping study surfaced critical issues for banks and credit unions, including how 58% of branch visits begin without a welcome, 62% don’t inspire intent to return, and 98% fail to leverage digital or tech-enabled handoffs that make the visit more consistent. These findings reveal misalignment between intention and execution. In her keynote, Gina describes this as a “chain of disconnect” where there are gaps between analytics, strategy, design, and deployment that weaken the overall impact of the experience.

Closing the Experience Gap

Transformation doesn’t just stop at branch design. Real change begins when institutions turn insight into action. Data must guide not only where institutions expand, but what format they put where and how they invest in staffing to elevate the experience and create connections with customers. Gina says, “Insight is often gathered, but not meaningfully activated.” This means banks and credit unions may focus on data for decisions about ideal locations and opportunities in markets, but sometimes fall flat in translating insights into meaningful choices about staffing, layout, technology, and advisory spaces.

Purpose-led design ensures form follows function, with branches tailored to expansion, loyalty, community, or efficiency roles, rather than relying on homogeneous templates that aren’t tailored to market or customer needs. Execution must also evolve to support speed and scale. Institutions making the most progress are leveraging modular kits of parts, tiered investment strategies, and flexible construction approaches that shorten timelines while improving cohesion across the network. Examples like Civic Credit Union’s rapid rollout show how minimal build-outs, adaptable furnishings, and streamlined standards accelerate delivery without sacrificing quality.

The Takeaway

Future-ready branch networks depend on turning insights into functional decisions about how locations operate, how staff support customers, and how design reinforces the purpose of the branch channel. Banks and credit unions that make these decisions deliberately and execute on them consistently will create experiences that are meaningful and meet the moment. “You can have the most beautiful prototype, but if it isn’t designed to be scalable and replicable across the dozens of scenarios you’ll encounter, it won’t make meaningful impact,” according to Gina. “Insight should guide decisions, design should support the role of each branch, and execution is where everything becomes real.”

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.