In a rapidly shifting banking environment, financial institutions are reimagining branches as powerful assets for creating customer connection. According to Rivel’s National Benchmark data, 52% of consumers say they visited their primary bank branch between 1-4 times in the past year. As more than half of all consumers seek out branch banking, financial institutions must make the most of every in-person interaction to strengthen and sustain relationships. From modern finishes that reflect brand presence to layouts that invite conversation, banks and credit unions are refreshing their physical spaces to deliver engaging experiences.

Behind each of these branch refreshes is a thoughtful mix of strategy and smart decision-making. Property considerations, lease terms, and investment realities shape what’s possible, while integrated technology platforms streamline design planning and implementation. For banks and credit unions, what’s driving this activity is a renewed focus on experience and efficiency, as even modest updates can boost pride among staff and confidence among customers. As Brad Parrish, Senior Director of Enterprise Design Integration at Adrenaline, explains, bank branch refreshes succeed when they’re grounded in both brand and business.

Why does customer experience and consistency matter so much in branch refreshes?

At the end of the day, the refresh is about people. Customers notice when a branch feels disconnected – maybe the layout is unfamiliar, the finishes look tired, or the signage doesn’t match what they’re used to at another location. That lack of consistency can create uncertainty: “Am I in the right place? Where do I go?” Refreshing that physical banking space brings alignment across the network so customers feel comfortable and confident, no matter which branch they visit. That familiarity goes a long way toward creating trust and building stronger relationships.

The impact extends to staff as well. Financial institution employees spend more of their waking hours in the branch than anywhere else, so working in a refreshed space makes a difference in morale. When their environment looks updated, they feel prouder and more energized, which directly influences how they engage with customers. Even relatively modest updates, like fresh paint, new flooring, or updated signage, signal that the institution values the space and the people in it. That sense of care translates into better service, a more welcoming atmosphere, and ultimately, a more engaging customer experience.

How do leasing considerations affect decisions about refreshing a bank branch?

Lease terms can really make or break the decision to invest in a bank or credit union branch. Institutions get tenant improvement (TI) allowances, but those dollars usually come with conditions. The money has to be spent in ways that benefit the building or prepare the space for future tenants, so clients have to think carefully about what’s worth doing in a location that may only be theirs for a few more years. If a lease is set to expire in five years, for example, a full-scale renovation might not make sense. Instead, Adrenaline often helps clients focus on high-impact, lower-cost refreshes that improve the retail experience now without over-investing in a short-term location.

We also perform what we call opportunity assessments on potential lease spaces. That means surveying the site, building test-fit plans, and checking feasibility for signage and branding under both landlord restrictions and local codes. Clients use these assessments to negotiate leases, validate TI allowances, and make sure the space works for their operational model before they sign. It’s about protecting the investment and aligning it with long-term strategy. A bank branch refresh should never be done just for the sake of updating. The project has to fit within the realities of the lease, the market potential, and the financial institution’s growth plans.

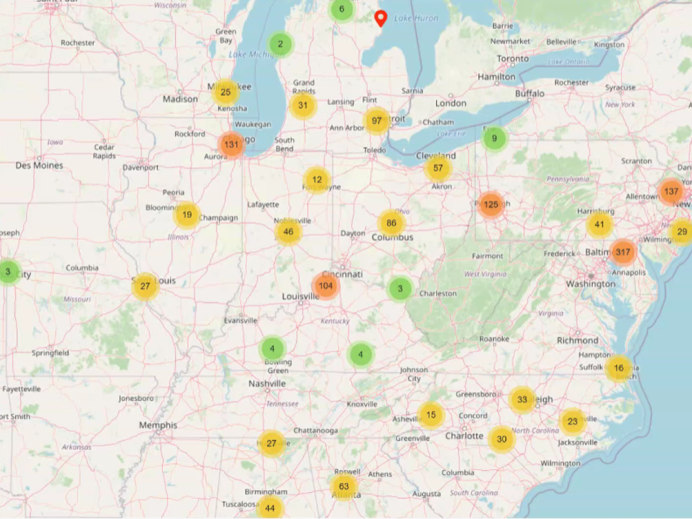

Adrenaline’s Asset Management Platform (AMP) is a real-time platform that’s essential for keeping refresh programs efficient and consistent. Once we complete field surveys, all the data is uploaded into AMP. That includes everything from 2D floor plans and interactive 3D models to full asset inventories. Clients don’t have to send their teams out to dozens of branches to see what’s happening; they can review conditions virtually, side by side, from their desks. We capture and catalog every fixture, finish, and feature, whether it’s paintable square footage, flooring, signage, or even the model numbers on digital screens, so we know exactly what exists in each location. That precision allows us to scope projects accurately, understand the gaps, and prioritize work with real numbers behind it.

AMP also becomes the hub for communication and approvals. Instead of endless email threads or messy spreadsheets, all project documentation, comments, and status updates live in one place. Clients can see progress dashboards in real time and even join us in walking through a virtual model if they want to double-check a detail. This transparency gives everyone – facilities, marketing, retail, and IT – a shared understanding of the work, which speeds up decision-making and reduces costs. It’s not just about efficiency; it’s about confidence. Clients know what they’re approving, and they trust that the program is being managed in a consistent, measurable way.

To learn more about success strategies for bank and credit union branch refreshes, or to speak with one of Adrenaline’s experts, contact us today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.