Banking M&A at a Glance:

- In 2025, there were 181 deals announced, a 45% increase from the prior year

- Institutional appetite and capital availability for M&A expansion have seen marked improvement in the last year

- Major banks are investing in both technology and branch expansion to strengthen deposit strength

- M&A is accelerating, but brand unification and branch strategy are emerging as core differentiators after the deal closes

After several years of economic uncertainty, profitability pressure, and regulatory friction, this year’s Bank Director’s Acquire or Be Acquired (AOBA) conference struck a decidedly different tone. Conversations are less about resilience and more about readiness. “The industry outlook is phenomenal,” says Gina Bleedorn, President & CEO of Adrenaline. “All the cylinders are firing, and the industry is moving in the right direction.” Key signs of banking growth – including institutional momentum and capital availability – have seen marked improvement in the last year, which will reshape decision-making across the banking sector.

What makes this moment different is not just improved performance metrics but renewed appetite among leaders for strategic action. Last year’s optimism was disrupted by macro-level economic uncertainty. While some headwinds remain, banks are shifting from the defensive (capital preservation) to the offensive (capital deployment). Institutions that made investments over the past two years have been largely focused on balance sheet defense, but they’re now ready to revisit expansion strategies. “M&A is back on the table,” says Gina. “Banking growth is back on the table with capital available that’s going to be spent.”

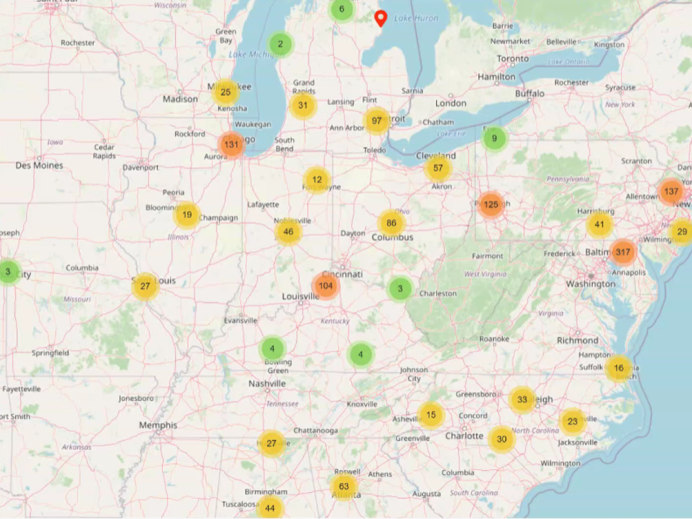

Demand for Deposits

While industry indicators have improved, competitive pressure remains high. A total of 181 deals were announced in 2025, a roughly 45% increase from the prior year, according to S&P Global Market Intelligence. That acceleration reflects renewed confidence, but it also underscores the pace at which consolidation continues to reshape the competitive landscape. Because deposit concentration still favors the largest institutions, the sheer scale of big banks gives them an advantage over smaller players. But what stood out at AOBA was not resignation among regional and community banks, but recalibration.

Institutional scale is the key driver of growth. Major banks are investing aggressively in both branch expansion and technology modernization to reinforce deposit strength. According to Andrew Johnson, Head of Account Management at Adrenaline, “The goal is not to out-Chase Chase.” Instead, smaller banks are “trying to hone their market on the periphery” while facing the reality that deposits continue to consolidate among the largest banks. That distinction matters as deposit size influences profitability and valuation. But it’s brand to branch experiences that influence loyalty and retention.

Brand and Branch Strategies for Impact

While scale may influence earnings and valuation, it does not automatically create customer engagement. What smaller institutions lack in national footprint, they can counter with precision – strategic brand positioning, intentional market selection, and a branch experience that reinforces trust. That consistency must extend into the physical experience. Don Mallory, Senior Director of National Accounts at Adrenaline, cautions against treating branch investment as a cosmetic exercise. “I believe it’s a shortsighted view to focus on signage or exterior updates without addressing the broader in-branch experience.”

As Gina emphasized during her panel at AOBA, post M&A integration is not simply operational cleanup after a deal closes. “The brand name is not just a name,” she explains. “It’s intrinsic to who you are and your culture and your strategy.” When brand identity reflects institutional ambition, banks send a clear signal to employees, customers, and the market exactly what growth will look like. As David Ehlis, the CEO of Bravera, noted, “People say they see us everywhere now, but we’re in the same places we were before.” That kind of shift in visibility isn’t driven by additional locations alone, but by brand impact in the market.

Strategic Positioning for Growth

As deal volume accelerates, the defining question for banks is no longer whether consolidation will continue, but how institutions intend to compete. “Consolidation is going to continue to accelerate,” according to Don. “And we need everyone to be prepared for that.” Preparedness, however, does not mean passive acceptance but rather requires strategic decision-making. Expansion approaches are becoming more disciplined – focused on markets where brand strength and community connection can create competitive advantage. For institutions under $10B in assets, developing a meaningful growth strategy is essential.

For all banks, brand and branch strategy move from supporting roles to intentional levers for growth. Andrew says, “Do you see scale as impossibility or opportunity?” In a cycle where capital is available and growth momentum is returning, institutions have more agency than they may realize. Some banks will pursue disciplined acquisitions to expand their footprint. Others will focus on strengthening franchise value to command a premium position in a future M&A transaction. Both paths require clarity about the role of the brand and the branch.

This current M&A environment is an opportunity for institutions to redefine how they compete with branch presence and brand power. “Everyone uses the branch, but in different ways,” according to Gina, reaffirming that growth is not about abandoning fundamentals, but evolving with intention. The next wave of banking M&A will not be shaped solely by deal volume, but by the institutions that marry growing capital to institutional purpose. “Growth doesn’t happen by accident,” says Gina. “You have to decide who you want to be and then build toward it.”

If you’re a banking leader looking for M&A solutions for banks and credit unions, get in touch with the experts at Adrenaline.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.